Superior Staking with rUSD

rUSD staking brings a unique, diversified return profile, resulting in superior risk adjusted returns

By Artur de Araujo, Head of Quant Research at Reya Labs

In a world where financial systems remain fragmented and inaccessible to many, Reya Network is building the infrastructure to bring global finance on-chain - creating an inclusive, unified financial ecosystem that works for all of us.

Reya Network has been designed with two principles in mind:

- The conviction that the DeFi revolution only makes sense if it is about financial decentralization, and not just technological distribution — DeFi FTW;

- The opportunities of financial decentralization can democratize superior, risk adjusted returns to everyone.

The results speak for themselves: Reya’s AMM is unrivalled in execution and depth, while generating incredible returns for LPs; and the Liquidity Manager framework, in partnership with powerhouses Selini and Amber, has unlocked institutional-level wealth creation, and built a bridge between CeFi’s massive liquidity and DeFi’s accessibility.

Staking rUSD gives you access to these groundbreaking achievements. Let’s see all the benefits that staking rUSD on Reya Network will bring you.

Reya has the best risk-adjusted returns out there

rUSD staking brings a unique, diversified return profile, resulting in superior risk adjusted returns

Most staking platforms put all your eggs in one basket. Reya's Network Liquidity takes a fundamentally different approach through our unified liquidity framework. This means that liquidity is deployed across a range of use cases. Currently,

- It provides the capital used by the AMM to underwrite perps

- It is mostly held in sdeUSD, providing exposure to its yield (RNIP1)

- It is also deployed through the novel Liquidity Manager (LM) mechanism, internalizing yield and order flow from elsewhere (esp. CEXs) into the Network

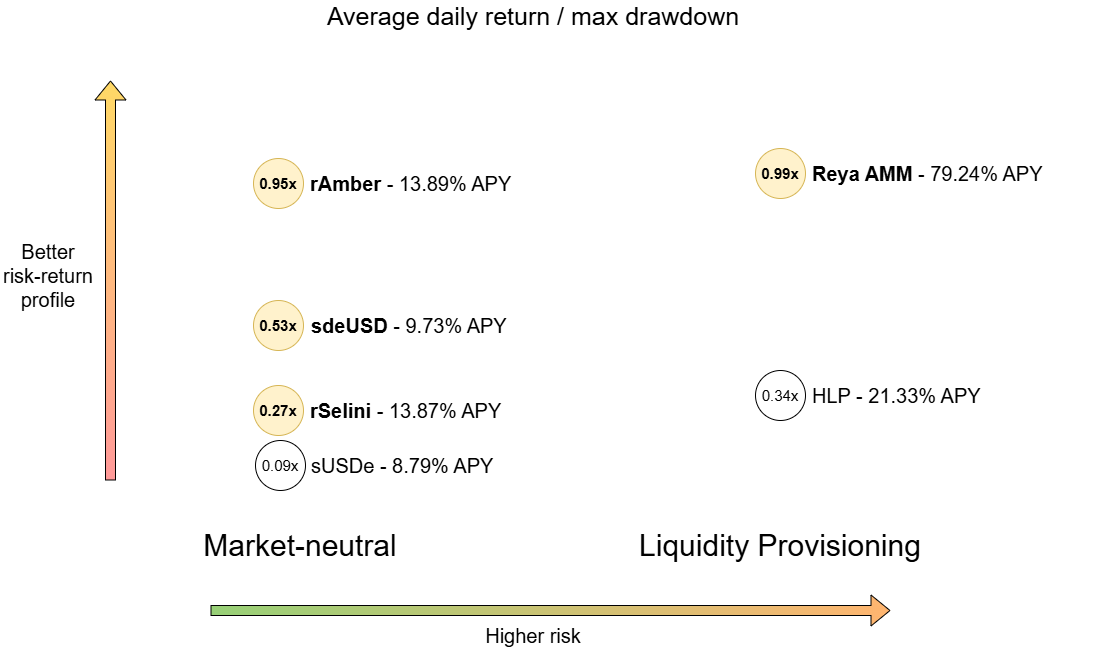

The different components work together to reduce the risk of rUSD staking, and improving the risk adjusted returns. One way to quantify it it (and benchmark each component against the market) is to compute the average daily return divided by the maximum daily loss, or ‘max drawdown’. The following picture gives an idea of just how far superior the risk adjusted returns are for staked rUSD.

rUSD staking consistently pumps high yield without a single day of drawdown

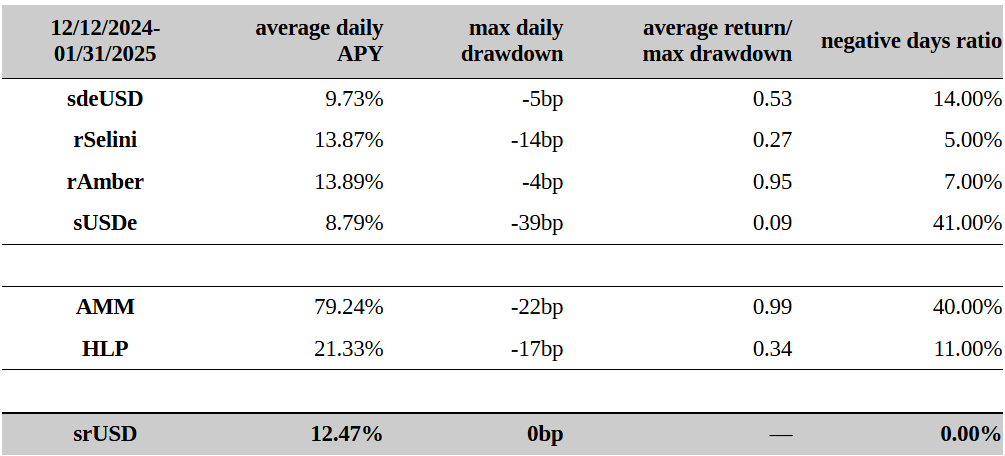

Let’s get straight to the point: LPs on Reya have seen their capital pump excellent returns through some wild market conditions — without a single day of losses since the introduction of the LM mechanism (even longer). Here is a summary table of the data behind the graph above:

When you put the graph and the table together, you can see that while you can find higher returns (e.g. HLP, or Reya’s AMM by itself), those sources of return expose you to the risk of losses. Reya provides you with high yield with controlled risk through diversification and superior execution.

The LMs bring market-neutral strategies on Reya to a pro level

Selini and Amber have joined efforts with Reya to bring pro execution to its market-neutral strategies. The results are clear: they have generate APYs that are 60% higher than sUSDe’s, all with a fraction of negative days or drawdowns.

And this is just the beginning! As the LMs move out of the POC stage, they will play a role in growing the ecosystem. The LM mechanism will provide a way of supporting activity in the Network, e.g. by enabling hedging of the AMM’s exposure as well as new markets.

The AMM mechanism generates stellar returns with controlled risk

The AMM is an essential component of the Network. It has been essential in bootstrapping all kinds of liquidity on the Network, and it is providing invaluable learnings for the next generation of truly on-chain trading.

But the AMM is also a money pumper. Using Hyperliquid LP Vault [HLP] as a benchmark for the AMM, the AMM provides not just stellar returns, but superior risk adjusted ones. Indeed, as a simple benchmarking, Reya’s AMM almost triples HLP’s average daily APY / max drawdown (a sort of Sharpe ratio geared towards loss aversion): 0.99 for Reya AMM v 0.34 for HLP.

Your rUSD stake does all this — on-chain

Importantly, your Network Liquidity stake is safely and transparently on-chain. Anyone can check on chain transactions and balances. Reya Network lives by the creed to true decentralization.

Being on-chain also carries its own specific types of risk, i.e., smart contract, bridging and Network risk. Every on chain component is thoroughly tested, audited and monitored, no protocol is entirely immune to security risk. Additionally, unavailability of the Network or the bridges might prevent you from withdrawing your funds temporarily.

Mechanism and innovation

Reya’s conception of Network Liquidity is about financial decentralization, not just settlement or technological decentralization

The DeFi summer brought high hopes of a truly decentralized finance, one that not only uses a distributed payments and settlement system, but truly changes its center of gravity away from centralized intermediaries.

Such a revolution was never going to come easily. There have been many challenges in finding the right balance in decentralizing while preserving enough flexibility to adapt and protect users from being rekt. These difficulties have even created a certain regression to financially centralized mechanisms.

The Reya Labs team is a group of DeFi OGs that designed Reya Network with the conviction that it only makes sense if it advances towards financial decentralization — DeFi FTW. From day one (indeed, since back in Voltz’ days!), all execution, settlement and margining has been fully on-chain and non-custodial. Your retain control of all your funds, and direct access through RPC allows you to verify all the logic for yourself.

Reya AMM mechanism brings a superior passive liquidity provision to the everyday degen

More fundamentally, the AMM mechanism provides a financially decentralized means of passively accessing LP yield. Most people do not have the time or resources to actively LP (whether on an order book, or on a concentrated liquidity AMM), and therefore miss on an efficient use of capital. The pegged AMM mechanism bridges this gap without relying on centralized financial entities, but creating an on-chain mechanism that uses capital efficiently while also offering superior trading conditions.

Indeed, the pegged AMM introduced some major innovations:

- It enabled leveraged on-chain passive LP’ing for the first time;

- It is pegged to perp prices on major CEXs, in an industry first;

- It deploys ultra-performant oracles that not only ensure efficient pricing for perps, but can be used by anyone on Reya Network.

But the pegged AMM is only the first step. The holy grail is to bring price discovery on-chain while preserving the AMMs best features. Stay tuned!

The Liquidity Managers framework is bringing pro-trading firms for the benefit of everyone

Amber and Selini joined efforts with the community to create a POC of the Liquidity Managers mechanism. These are some pro trading powerhouses making their expertise available to the community as a whole. Reya is literally bringing down the fences, and democratizing access to financial expertise.

LMs can also work to increase collective force and momentum of Reya Network as a whole

The LMs are an important element of the roadmap, and will play an essential role in supplementing and supporting the growth of the on-chain ecosystem. The current POC has focused on creating diversified, superior returns for Network Liquidity while internalizing CEX order flow. But the role of LMs is expanding already by supporting the activity of the AMM through hedging, and many more such use cases lay ahead.

Building the next chapter of finance

Through Reya's unified liquidity framework, innovative AMM mechanism, and strategic partnerships with elite trading firms, we're delivering what DeFi has long promised but never achieved: true financial decentralization paired with institutional-grade performance. By bringing together purpose-built infrastructure, deep liquidity pools, and sophisticated trading strategies in a fully transparent, non-custodial system, Reya Network isn't just improving DeFi - we're laying the foundation for the future of finance. Stake your rUSD and be part of the revolution.

Stake now: https://app.reya.network/