Superior Trading on Reya

Reya Network is building the future of on-chain trading.

In a world where financial systems remain fragmented and inaccessible to many, Reya Network is building the infrastructure to bring global finance on-chain - creating an inclusive, unified financial ecosystem that works for all of us.

Along the way, it has brought to reality unprecedented features: a unified margin account with which you can trade across a variety of DEXs, including spot assets ‘flash swaps’; yield on your margin balance; and let us not forget the titans that joined the Network as Liquidity Managers.

But it is important to always return to the basics: Reya excels in bringing to every trader the most reliable and deep markets in DeFi. It does so by supporting itself on three core pillars: Liquidity, Performance and Capital Efficiency.

Let us see how these pillars make ReyaDEX reign supreme in execution across DeFi.

Liquidity

All markets share the same pool of Network Liquidity, ensuring that maximal amount of liquidity available for any markets at any time

While each market is weighed differently, all markets share a common pool of Network Liquidity. You will find the maximal amount of liquidity available for any markets at any time: capital is locked according to actual trading activity, and not hostage to siloed pre-allocations of liquidity. And more importantly, you will never find yourself locked into a position for lack of liquidity!

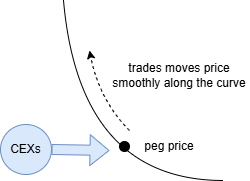

Reya’s pegging mechanism to CEX’s perp markets ensures the best pricing on your trades.

ReyaDEX uses a pegging mechanism that anchors the prices to Stork’s ultra fast price data feeds from major CEXs: Binance, OKX, ByBIT. This ensures you always get the best and freshest reference price on your trades.

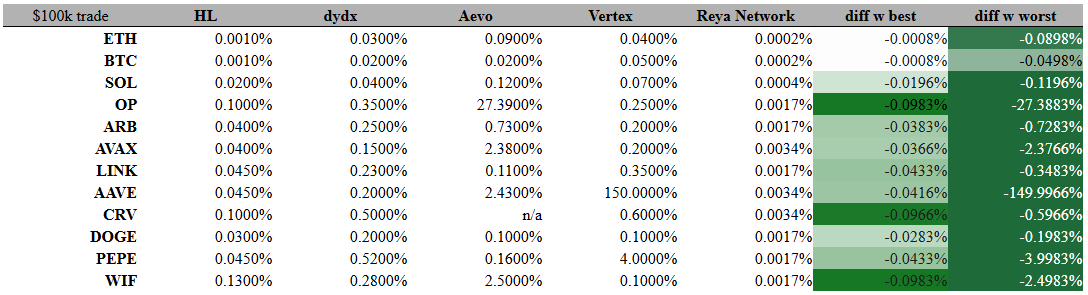

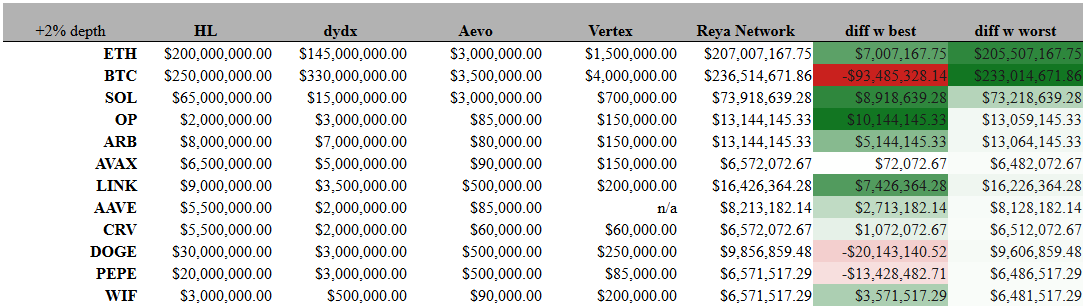

Reya has unrivalled depth among DEXs. Let’s illustrate this in two, ‘converse’ ways:

- One way to assess this is through price impact of trades: how much an order of a given size moves the price on the venue. The following table summarizes the price impact of a $100k trade across various venues:

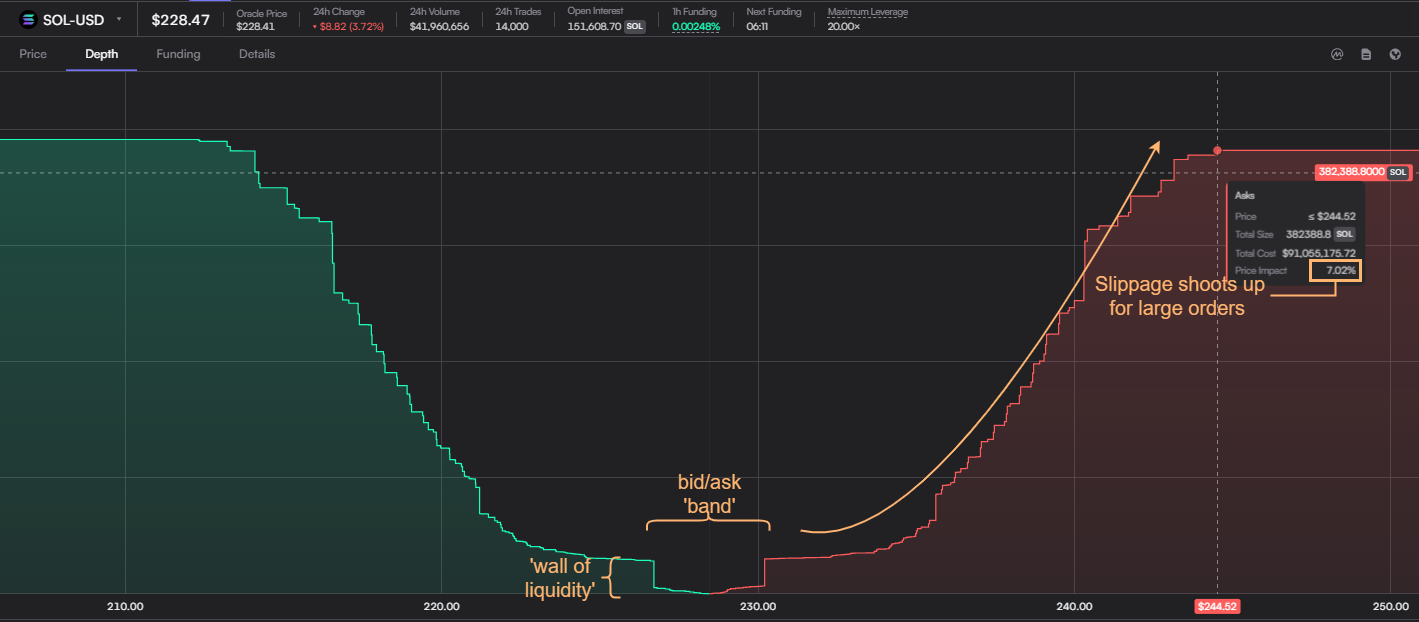

- Another way is to sort of invert things, and check the 2% depth: the maximum trade size that you can reliably execute with less than 2% slippage. Reliably is the operating word: not just 2% during good times, or in that split second). The 2% depth is an important number because often in an order book one finds a ‘wall of liquidity’ hugging the bid-ask spread, but orders are hit with oversized slippage after that, especially as volatility increases. This does not happen on Reya.

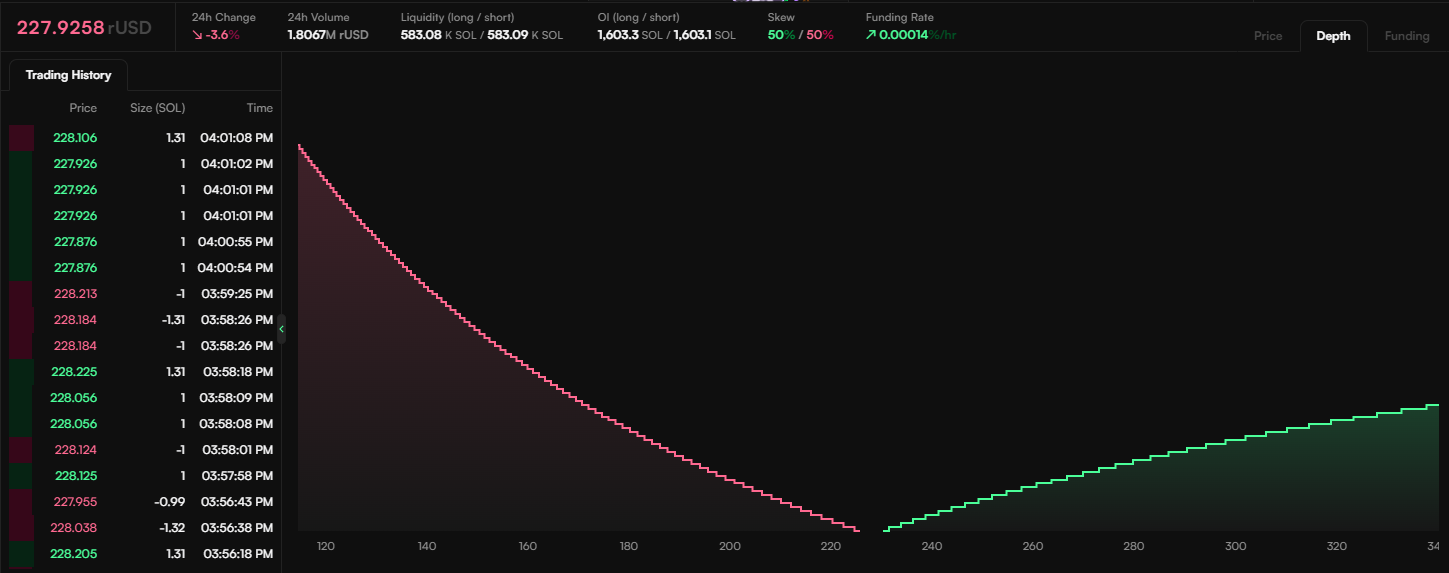

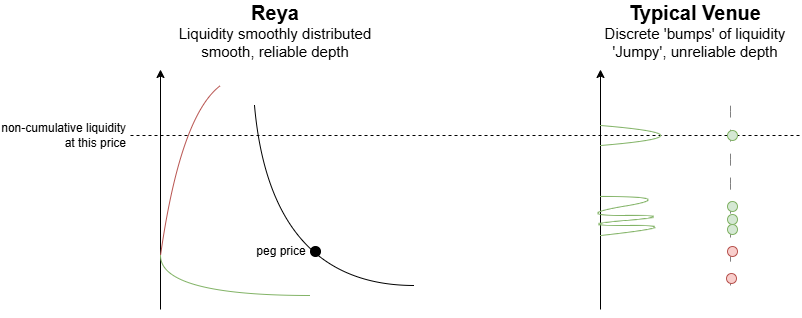

Reya markets offer smooth and predictable depth by deploying trading on a curve

Depth on Reya, while responding to the volatility environment, is always smoothly and continuously distributed along a curve pegged to CEX prices. Put simply: no more jumps after the first layers of the book; no ‘wall of liquidity’; no sweeping of shallow levels resulting in uncontrolled prices. The price impact of your trade is predictable according to the size of your order: a large order’s slippage won’t change from a basis points to up to 20% as seen in widely used order books.

Let’s see this in detail. Here is dydx’s depth chart:

and here’s Reya’s:

This is because the pool distributes its liquidity continuously along the curve, creating predictable price impacts.

Because all trading on Reya is against the pool, trading is not hostage to the instantaneous liquidity at execution time

Each trade is directly executed against the pool’s liquidity along the curve. This means that while limit and other conditional orders are available, each market order is not subject to the amount of liquidity offered by other traders at that same precise instant. The pool acts as a ‘buffer’, protecting both Makers and Takers from information leakage, simplifying and optimizing execution.

Performance

With 100ms block times and 99.9% uptime, Reya Network is the highest performing trading optimized network

This means that transactions can be pushed through at record speeds, allowing you to deploy fast automated strategies. Whether you are an HFT institutional trader, or a DeFi-pro deploying sophisticated strategies, Reya Network is an ideal addition to your trading on price or rates misalignment across DeFi.

Deploying Stork’s 10ms updates data feeds, Reya Network oracles have the most accurate pricing on-chain

Reya’s oracles showcase the power unlocked by the Network’s ultra-performant chain layer, by integrating Stork’s ultra fast price data feeds from major CEXs (Binance, OKX, ByBIT) with Reya’s high frequency blocks. The oracle updates happen every block, so every 100ms (with an average per-market update time of 400ms), and the data written by the oracle has a maximum staleness of 10ms!

By focusing on trading, Reya Network offers predictable costs and eliminates front running and MEV

The customization of Reya Network for trading purposes allows for an architecture that is designed to prevent front-running and minimizing Maximal Extractable Value (MEV) issue at the sequencer level. By internalizing gas into the fees, Reya Network brings predictability to your trading costs.

With high quality programmatic access, Reya Network allows pro-traders to make the most of the Network’s performance

ReyaDEX offers top-tier programmatic trading, blending cutting-edge features with an intuitive UI. It provides both query driven (REST API) and event-driven (websocket) connections, with the latter enabling seamless integration of Stork's real-time data feeds into your trading bots.

A Python reference implementation that leverages the websocket connection, complete with an example script for automatic transaction execution based on your custom trigger functions was released recently.

Capital Efficiency

Unified margin account

On Reya Network, the clearing layer is abstracted away from the application layer, and you margin account(s) is at the Network level. How this affects your capital efficiency? You can use the same margin account for both perps and spot trading. An combining both with cross-collateralization, your use the same margin account to execute a leveraged basis trade.

Cross-collateralization and yield bearing assets

You margin account has the ability to recognize collateral in different tokens. This means that you can hold on to your existing assets while still trading. Cross-collateralization is especially powerful given that Reya supports yield bearing assets as collateral! Deposit sUSDe or deUSD, and you’ll accrue interest on your margin balance, while holding positions against it.

Flash swaps

The power of Reya’s focus on trading is fully displayed on flash swaps: the unified margin account allows you to swap collateral assets with a deferred margin check. What this means is that if you are using cross-collateralization and need to cover losses in rUSD, you don’t need to reduce exposure, withdraw the collateral tokens, then swap them to rUSD and deposit them back. Instead, you can trade on Camelot directly from your margin account, and avoid reducing the exposure.

(Portfolio) Cross-margining

Each margin account allows for capital optimization by recognizing you portfolio as a whole across every DEX by enabling:

- Losses from one position with profits another, and enabling leveraging of all portfolio profits immediately

- Margin requirements, by recognizing the P&L offset that can happen between positions

- P&L and margin across exchanges, by aggregating all positions into a single settlement and clearing layer

Secure and Automated Liquidations

To protect traders and the broader ecosystem, ReyaDEX employs a comprehensive liquidation mechanism. This automated system ensures that losses are minimized and that the network remains solvent, even during periods of extreme market volatility. Additionally, the collateral liquidations convert collateral tokens to rUSD, ensuring that traders can meet their margin requirements without manual intervention.

Importantly, the exposure and collateral liquidations are designed to improve trader experience while keeping the system safe.

- It tries to do small partial exposure liquidations to keep your margin account overwater, only doing a full liquidation as a last resort.

- It also liquidates collateral in partial amounts but more importantly, in a just-in-time manner.

Make Superior Trades on Reya

Trade on ReyaDEX now: app.reya.xyz

Learn more in the Reya Docs: docs.reya.xyz