Reya Network Phase 2: becoming DeFi’s liquidity hub, supercharged by connecting $35 trillion of offchain orderflow

TLDR

- DeFi liquidity is heavily fragmented, holding back growth due to inefficient capital flow

- Meanwhile, 98% of trading volume is still locked in CeFi, fragmented away from DeFi users

- Reya’s unified liquidity hub addresses both these issues by allowing Liquidity Managers to deploy Reya Network liquidity to DeFi and CeFi venues

- This network-owned-liquidity model creates a more efficient mechanism for allocating capital to Reya Network projects and opens up return opportunities from $35 trillion of annual orderflow in CeFi, generating value for network stakers, liquidity managers and the overall ecosystem

- Powered by a novel tokenomics design, the model is designed to enforce fair distribution of returns and activate organic ecosystem growth.

- The ticker is REYA.

The Problem

Remember when Goldman Sachs was dubbed the "great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money"? Reya is pulling the ultimate Uno Reverse card. We're bringing back the liquidity-sucking vampire squid – but this time, it's being used as a force for good by creating channels where liquidity can efficiently flow from CeFi to DeFi. In doing so, it will supercharge ecosystem growth on Reya Network whilst solving one of the biggest problems in Crypto – liquidity fragmentation.

Or more simply - DeFi is good. But lots of volume (98% of it) still lives offchain. The question is: can we connect this massive source of liquidity to supercharge DeFi’s growth?

Enter Reya

Phase 1 – Proof of Concept

At ETH London in November 2023 I introduced my vision for Reya – a unified liquidity network that addresses the problem of liquidity fragmentation throughout crypto. To deliver on a mission this big, we first needed to showcase how DeFi is ready to supersede CeFi as crypto’s primary liquidity infrastructure. This was achieved in Reya Network Phase 1.

Built with the Arbitrum Orbit Nitro stack, Reya Network created a highly performant, low latency, reliable trading environment. When paired with a native DEX, we effectively internalized CeFi trading into the onchain world, with trading patterns to prove it.

This design created a unified network-owned liquidity layer, where DeFi builders could instantly access liquidity, traders had better execution and Network Stakers (LPs) could efficiently put their capital to work. This was immensely successful - the launch led to over $200m of liquidity in a matter of days, deeper markets than any other DEX, and there have been projects launching on Reya like Camelot that can’t even access the liquidity (yet!).

That proof of concept validated our hypothesis that we could replicate CeFi environments onchain. It also created the backbone for the project's ultimate vision: becoming crypto’s liquidity hub.

Phase 2 – “The Squid”

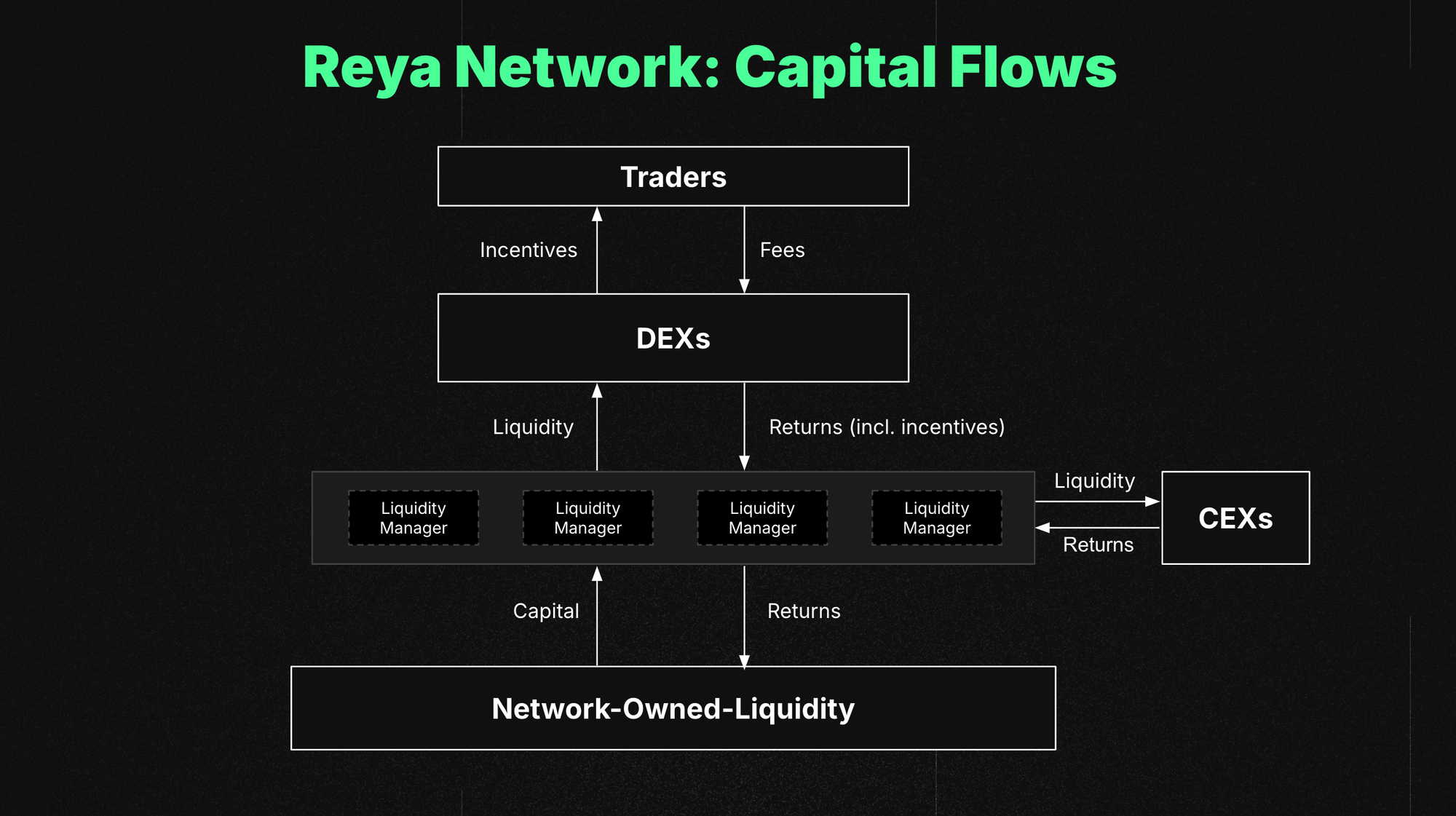

“The squid” is a simple idea: there is a ton of orderflow offchain that’s not connected onchain. Meanwhile, there is a lot of capital onchain waiting to be put to work. The squid is a novel mechanism that bridges these two worlds whilst simultaneously allowing for liquidity to be efficiently distributed across the Reya ecosystem.

In simple terms - this works through the introduction of a new actor, liquidity managers, alongside a novel tokenomics design. This design allows governance to efficiently allocate capital to Liquidity Managers they believe will generate returns that are beneficial to Reya Network. In doing so, “the squid” creates the following value for different actors:

- Network Stakers (LPs): collect yield

- Liquidity Managers: generate returns and internalize CeFi order flow

- Ecosystem Projects: efficiently access liquidity

- Traders on Reya Network: access deeper markets and a vibrant ecosystem of projects

It is worth adding that no liquidity ever goes onto the CeFi venues, meaning there is no counterparty risk that’s aggregated into Reya Network. More details on this will follow.

A simple version of this setup was introduced in RNIP1, where the community voted in favor of Elixir becoming the first Liquidity Manager. This setup effectively internalizes yield from CeFi trading strategies, albeit in a tokenized form rather than through direct connection.

The objective here is clear: create a win-win system that supercharges ecosystem growth by connecting CeFi volume to Reya Network. In doing so, creating enhanced trading value for every participant.

For network stakers (LPs), that means sweet, sweet yield.

Stop trading, believe in something

Some people know how to trade. Some don’t.

Reya Network connects those that don’t have the time or capabilities to generate trading returns with those that can, via an efficient marketplace powered by the REYA token. This marketplace lets Liquidity Managers deploy trading strategies on behalf of Network Stakers (LPs) to generate returns. Let’s assume there’s a trading firm as one of the Liquidity Managers.

This trading firm can request capital from governance and then use that as trading margin through DEXs on Reya Network, but also now on CeFi venues. Let's assume capital is used on a CeFi venue. This could be pricing arbitrage, options strategies, funding rate arbitrage or even market making strategies. It’s up to the Liquidity Manager to make the proposal to governance and, once approved, go execute.

But how does this benefit the Reya Ecosystem?

Well, now let’s assume there are incentives on a DeFi application on Reya Network. Those incentives encourage the Liquidity Manager to start doing every other leg of the current trading strategy on that dapp. All of a sudden, we just internalized 50% of the trading flow to Reya Network.

Network Stakers collect yield. Liquidity Manager generate returns. And Reya Ecosystem projects get supercharged.

Tokenomics as a flywheel

Let's be honest, recent tokens have sucked. And for a simple reason: the token flows failed to create alignment of interests between network agents.

The REYA token will address this problem heads on. Reya Network provides a reliable base Liquidity Managers can use to deploy sophisticated trading patterns that bridge multiple venues across CeFi and DeFi, generating returns for the Reya ecosystem. The tokenomics model will lean on the natural financial flows in this interaction to create organic growth and innovation that enforces a fair distribution of returns.

To achieve this, regular epochs of $REYA tokens will be distributed as determined by veREYA holders through the following controls:

- % distributed directly to Network Stakers

- % distributed to DEXs/Ecosystem Projects (who in turn can pass on to traders)

Given the relationship of Liquidity Managers, who interact with Network Stakers and Ecosystem Projects, there are a number of interesting dynamics that will start to emerge. Not least of all, these middlemen can become vessels through which token emissions travel - providing Ecosystem Projects the ability to attract liquidity and potentially providing a path for network stakers to receive emissions from those ecosystem projects.

The intention here is to create a powerful marketplace, achieved whilst addressing one of the biggest issues in the space. As always, we’ll build this openly with the community and look forward to sharing more details for discussion as we ramp up to the genesis event next year.

Next moves

Reya’s mission to unify fragmented liquidity and supercharge the growth of the DeFi ecosystem is unfolding in three phases, each one expanding the reach and impact of the network:

- Phase 1: The proof of concept: create CeFi level performance onchain (done!)

- Phase 2: The Squid: create the rails to open up 35tn of orderflow to onchain participants

- Phase 3: The ecosystem: leverage the powerful marketplace created by the tokenomics design and the squid to supercharge the growth of the DeFi ecosystem on Reya Network

The squid is in progress. The tokenomics are being designed. And we’re on a path to finally removing liquidity fragmentation across the crypto ecosystem. In doing so, it will open up trillions of dollars of orderflow onchain to supercharge ecosystem projects on Reya Network.

The Great Vampire Squid is back. But this time, it's a force for good.

Join our community and subscribe to email notifications on Ghost to stay up-to-date with all things Reya!