Upgrading Reya's Pegging Mechanism to Perp Prices

Reya Network is pioneering perpetual trading by pegging its passive pool to perp market prices, not spot. This shift enables CEX-like execution speed and efficiency, further improving the trading experience.

Pioneering the future of perpetual trading

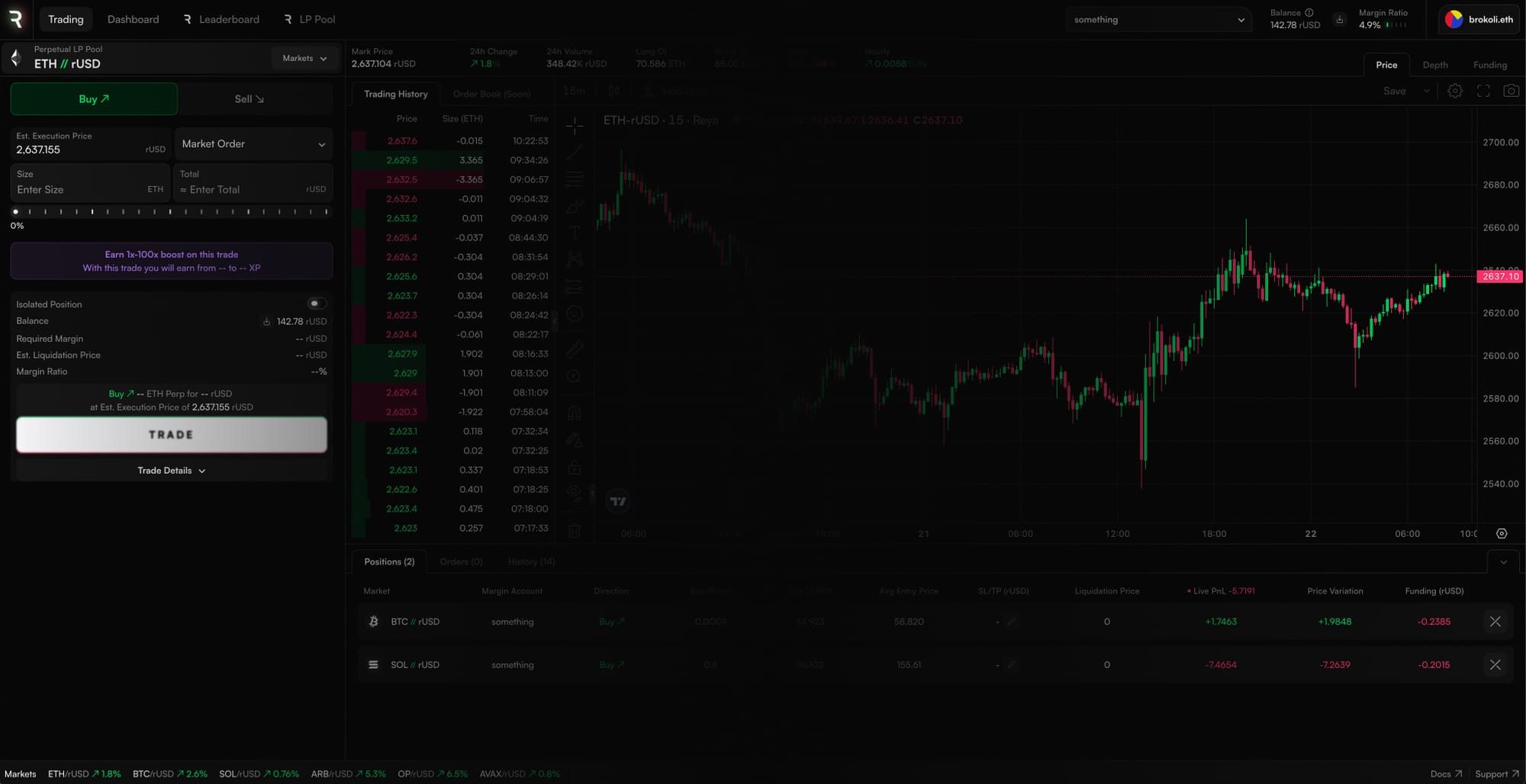

Reya DEX is committed to showcasing how Reya Network can deliver the best trading experience in DeFi. Today marks a significant milestone: the passive pool on Reya Network will now peg its prices to the perp market rather than the spot market. This change makes the pool in Reya Network the first in DeFi to directly reference perpetual markets when quoting prices for perpetual contracts, all powered by the combination of Reya Network’s 100ms block times and Stork’s real-time 10ms price updates.

Why this transition matters

While this shift may seem minor, it has major implications in both the short and medium term.

- Short Term Benefits: In the short term, pegging to perp prices streamlines the alignment of Reya’s prices and funding rates with CEXs, reducing operational risks and costs associated with cross-exchange executions. Prices on Reya Network adjust dynamically: above CEX prices when the pool needs short traders and below when it needs longs. When centered around perp prices, this minimizes execution risk for funding rate arbs with CEXs, helping traders to keep the funding rate on the pool closely aligned. This change offers immediate benefits to both traders and liquidity providers (LPs). Traders experience execution speeds comparable to CEXs or find profit opportunities when discrepancies arise. LPs see minimized risk on their capital through optimal rebalancing mechanics.

- Medium Term Vision: Over time, Reya Network will position itself as a critical on-chain link with CEXs, becoming the platform through which other DEXs achieve alignment and performance comparable to CEXs, all on-chain. While the pegging guarantees price alignment, the continuously accruing, dynamic funding rate will work as a discovery mechanism for funding costs in DEXs. Combined with a unified margin account on Reya Network, and you have a killer combination that sets a new standard for trading efficiency in DeFi.

Minimizing funding rate volatility

Reya Network’s approach aims to minimize funding rate volatility, which imposes significant costs on traders. Traditional passive pools rely heavily on volatile funding rates to incentivize rebalancing, but Reya Network seeks to offer optimal execution with minimal volatility. Pegging to futures prices helps maintain close alignment with CEXs, creating a dynamic where Reya’s funding rate oscillates around those of CEXs, reflecting the inherent liquidity conditions of on-chain trading and maintaining stable rebalancing.

What’s Changing?

- Switching to Perp Oracles: Reya Network’s current spot price oracles will be phased out and replaced by new perp price oracles. These oracles are purpose-built to fully utilize Stork’s low-latency data feeds and Reya Network’s high-speed performance. Initially, the spot market oracles were deployed to build confidence in the technology, allowing the ecosystem to adapt. Now, this infrastructure will evolve to deliver real-time perp data, while those relying on spot feeds can continue to build their own as demonstrated.

- Passive Pool Pegging to Perp Prices: The passive pool on Reya Network will shift from quoting around spot prices to referencing perp prices from major CEXs. This adjustment leverages the network’s rebalancing mechanism, which dynamically adjusts prices based on open exposure within the pool, creating an oscillating dynamic around perp prices. When trading on Reya Network, quotes will be centered around CEX futures prices and adjusted to reflect the pool’s trading imbalances, offering closer alignment with the futures market.

What You Need to Know

This is obviously an important change, so each component will be introduced in phases to manage risks and ensure a smooth process. Although the Reya Network roadmap is designed to mitigate these risks, some unusual price dynamics may still arise during the changeover. Detailed timelines will be shared in advance to keep everyone informed and prepared. Here’s a general outline of the phases:

- Smaller Market Transition: the smaller and newer markets will transition first, progressively transitioning from spot to perp prices to avoid abrupt changes, and artificial PnLs.

- Full Market Transition: after a stabilization period for the smaller markets, the bigger markets will transition next.

Moving Forward

This transition marks a pivotal step in creating the most advanced and trader-friendly DEX in the market while supporting ecosystem builders to access the same benefits. Directly referencing perp prices allows Reya Network to offer unparalleled trading precision, stability, and capital efficiency.

Stay tuned for further updates as these changes roll out. The transition unlocks new opportunities and continues to push the boundaries of on-chain trading performance.