The Reya Roadmap: Unifying DeFi, CeFi and TradFi into a Single Onchain Trading Hub

TLDR

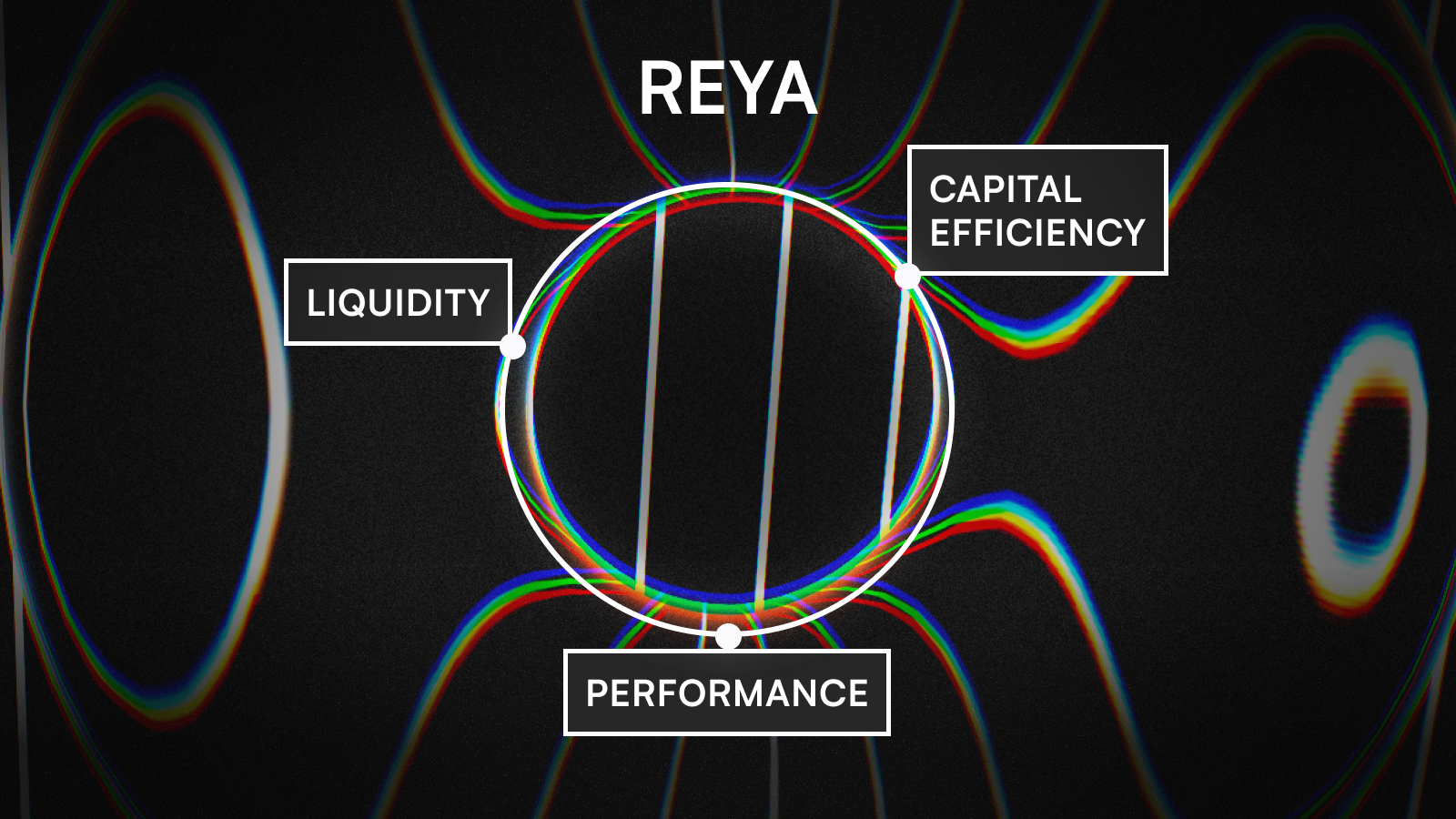

- Reya will unify DeFi, CeFi and TradFi trading into a single onchain hub, unlocking performance, liquidity and capital efficiency benefits for onchain traders.

- In doing so, a projected 16tn of TradFi RWAs will have additional utility as trading margin and 35tn of CeFi orderflow will be connected onchain.

- This unified vision will be enabled by ReyaChain, a purpose-built high-performance network that will create trading rails connecting these three worlds. Technical details announced in June.

- A native component of the chain is Reya DEX - which has been operating in a proof-of-concept state to date on a forked version of Arbitrum Orbit.

- Continuous focus on making Reya DEX market-leading is visible in the numbers; with an 8x increase in market share, 3x increase in trader retention, 5x increase in average trade size. Achieved with 99.8k users, 200k trades a week, 60 markets and market leading liquidity.

- The roadmap will now head towards a ‘Sprint to Sovereignty’, which will include the launch of ReyaChain, powered by $REYA , followed by continuous improvement of the trading rails required to unify DeFi, CeFi and TradFi to deliver value through to traders.

The Reya Vision

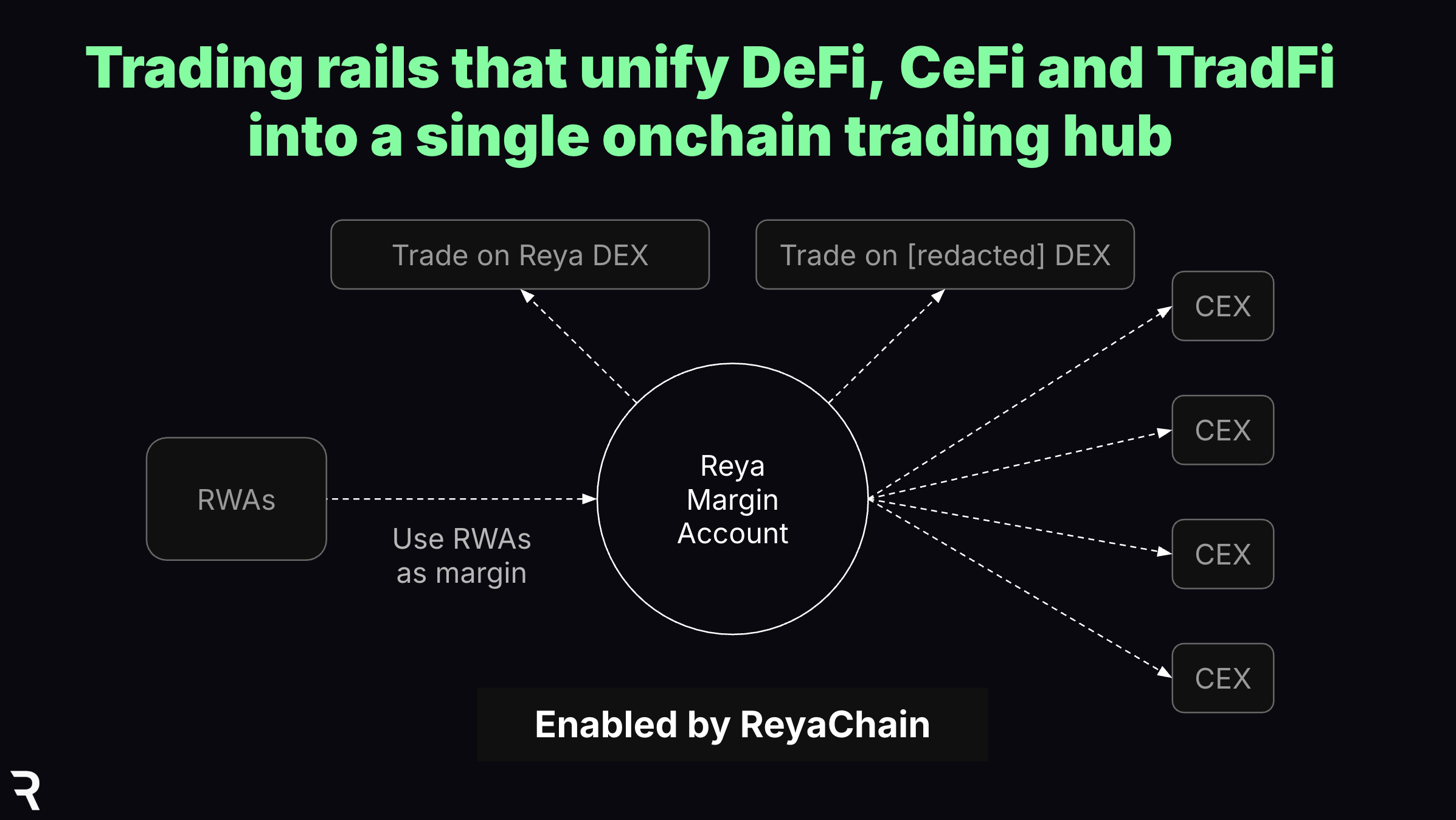

From day one, Reya's mission has been to deliver a demonstrably superior onchain trading experience capable of unifying DeFi, CeFi and TradFi into a single onchain trading hub. In doing so, we want to tear down barriers to access, open up distribution channels and ultimately drive capital efficiency and trading opportunities to our end users.

Imagine a world where a trader in Lagos can seamlessly access Blackrock products, use them as trading margin and then arbitrage European equities on a DEX and crypto derivatives on Binance, all from a single onchain margin account. Where DeFi builders can instantly tap into a rich ecosystem of liquidity, traders and capital. Where liquidity flows seamlessly between traditional finance, centralized exchanges and decentralized protocols — all transparent, composable and accessible to anyone with an internet connection.

That's the world Reya is building. To achieve this we have to create a network with the speed, throughput and scalability required by traders. But performance alone isn't enough. What sets Reya apart is our integration of financial logic directly into the network design, enabling cross-venue clearing, driving capital efficiency benefits, and allowing liquidity to be accessible to multiple applications at once.

Like Apple integrated hardware and software to create breakthrough user experiences, Reya's vision requires us to integrate application logic into the chain — all designed to create highly-performant low-level trading rails that can unify capital markets into one single hub.

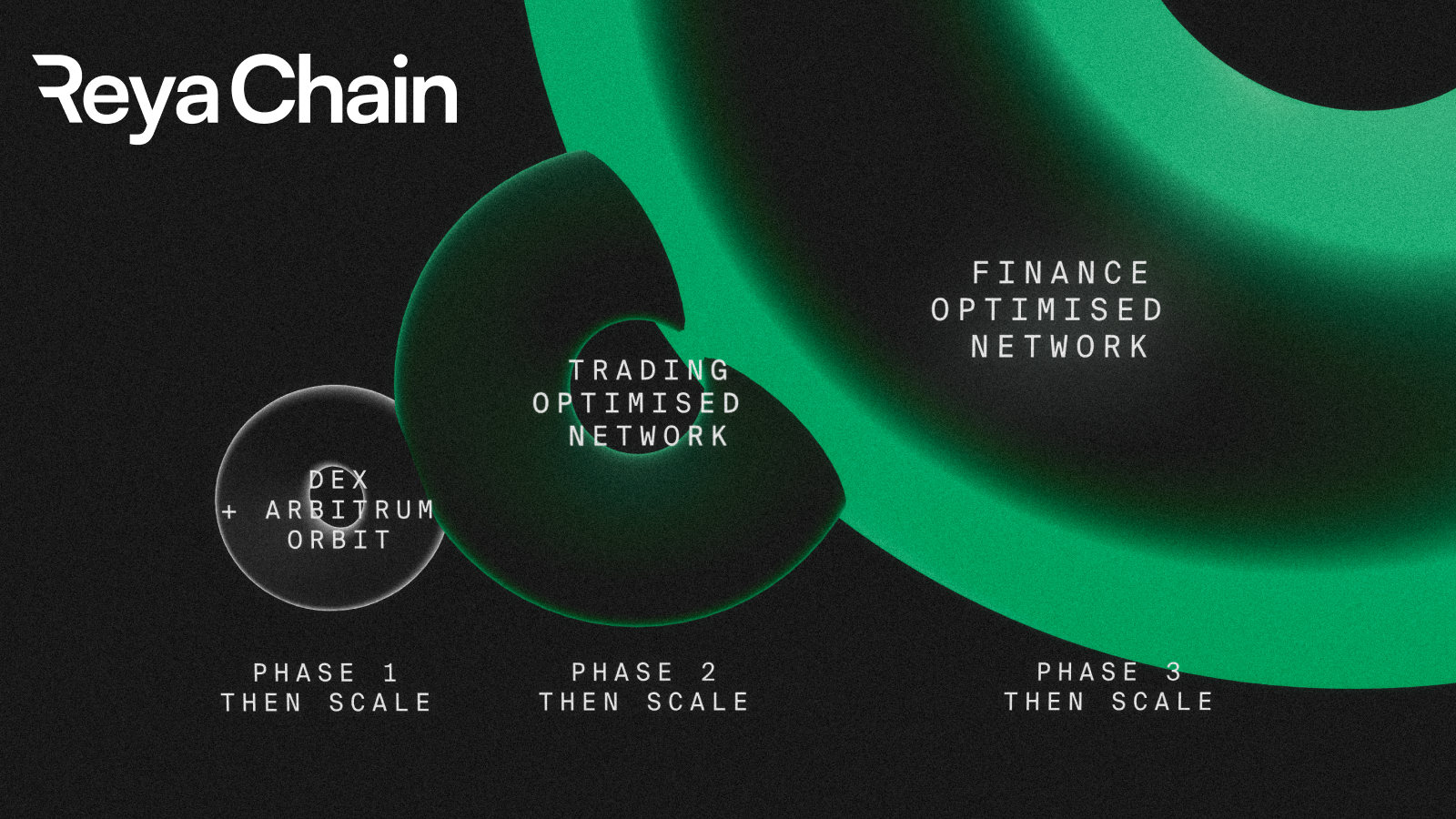

Turning Reya's three pillars — performance, liquidity, and capital efficiency — into a transformational product is an iterative process unfolding across three phases:

- Phase 1: Proof of concept; combining a forked Arbitrum Orbit with our smart-contract-based liquidity mechanism and DEX to generate learnings and validate our strategy.

- Phase 2: Trading Optimized Network; embedding advanced financial logic directly into the nodes of ReyaChain, whilst building connecting rails to other trading venues.

- Phase 3: Finance Optimized Network; integrating TradFi products while enabling a thriving ecosystem where projects can leverage Reya's embedded liquidity and capital efficiency to create entirely new categories of onchain innovation.

These phases overlap and build upon each other, with learnings from each iteration informing the next.

The Journey So Far

Delivering Reya’s vision requires steady, iterative progress — much of it beneath the surface.

Our strategy for 2024 was about validating our core ideas. The DEX rollout surfaced key lessons, chief among them that we held our liquidity-generation event before the underlying infrastructure and tooling were fully battle-tested. The resulting performance challenges humbled us, but they also forced us to reinforce every layer, end-to-end.

We now hit 200k trades a week. Across 60 markets, multiple collateral assets and multiple instruments. Achieved with a network that allows gas-free trading, has 100ms blocktimes, executes trades on a FIFO basis (avoiding harmful MEV) and has deep liquidity, high availability and a growing ecosystem of projects.

As this scaled we had to keep working hard on the DEX — week after week of optimization to reach the performance levels we set out to achieve, while also preparing us for the next phase of growth. This is not as easy as it sounds. One simple example that highlights the challenges encountered: we used to regularly max out the units of gas available on the chain.

As you can see in this chart from the explorer, gas could reach an eye-watering 100m units. Arbitrum Orbit can only sustainably support 7m gas units per second, despite 100ms blocks, meaning when the gas went above this it would cause critical infrastructure to fail. This is all abstracted away for users, who don’t pay gas, but these types of challenges had to be overcome to create performant, liquid, capital efficient trading at scale.

And that period of extreme focus is now visible in the underlying numbers. In 2025 so far we achieved:

Done whilst maintaining market leading depth across all markets:

Alongside this, we also launched ‘The Squid’ model. Our first attempt to create trading rails that connected $35tn of CeFi orderflow into a single onchain hub. This was a very successful proof-of-concept, generating superior returns for srUSD holders, whilst providing the learnings required to understand how we can fully connect CeFi liquidity into a single onchain margin account. This connectivity will ultimately unlock new trading opportunities and enhanced capital efficiency for traders.

As a side note: if you haven’t tried Reya DEX yet please go play with it. If you're a serious trader, you can make a VIP Fee Tier application here. And if you have feedback for us, please share it - we’re building Reya together.

The Path Ahead

Reya’s core concept has been verified in Reya DEX. Now we move from proof to permanence.

The next milestone is to unify DeFi, CeFi and TradFi into one single trading hub, enabled by ReyaChain. This will be a purpose-built network that puts the DEX and margining/clearing logic directly into its core. Traders will finally have the speed, throughput and composability they have been asking for while uniting the best of DeFi, CeFi and TradFi onchain. The technical details for ReyaChain will be announced next month.

Critically, this unification builds on the learnings generated so far, including ‘The Squid’ model announced in late 2024. And allows us to deliver on the original vision for Reya. In doing so, we want users to access the best of all three worlds - TradFi products, CeFi orderflow and DeFi transparency, efficiency and composability. Reya DEX will continue to be a critical part of this vision — attracting users, capital and activity and allowing new features and markets to be launched that are only possible onchain.

For our dedicated community members wondering “wen TGE?”: you’re right, it’s taken longer than we had hoped. We were always targeting early 2025, but needed to ensure that the product's fundamentals achieved the deep-seated stability and performance they exhibit today. A robust foundation first, then a token designed to accelerate it. That’s how we protect the community and guarantee long-term strength for everyone.

The Sprint to Sovereignty

Reya is entering a new period: the Sprint to Sovereignty. This is our race toward the launch of $REYA and the full decentralization of governance and incentives.

This sprint is how we put power in the hands of the community. Not just through ownership, but through utility: trading, staking, building and governing in a unified onchain financial hub. A hub that will continue evolving as we move towards delivering full-scale financial unification.

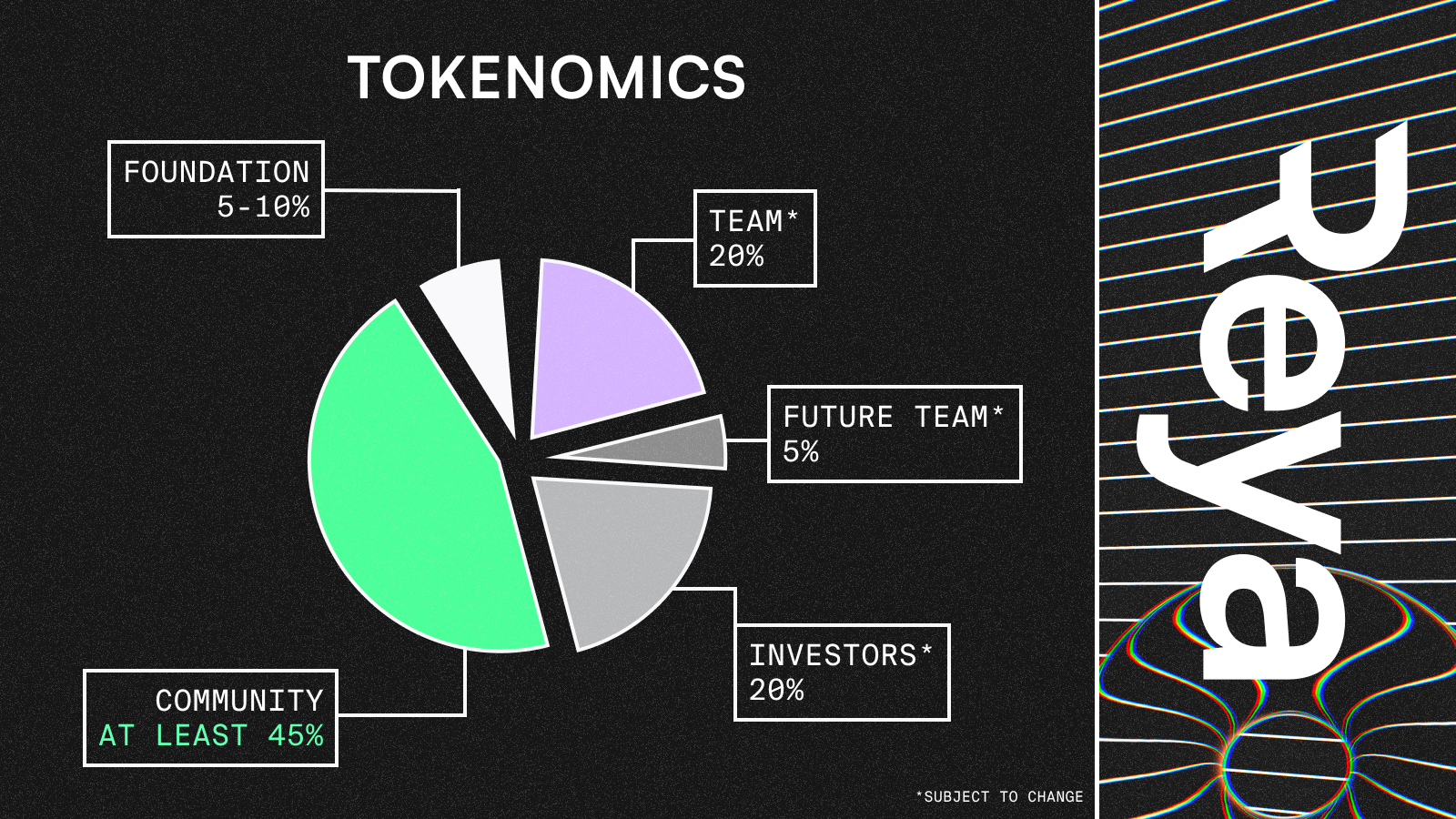

We plan on announcing the full design of $REYA and rUSD when we release the technical details of ReyaChain. However, for now, we want our community to know how committed we are to building openly and together as a community-first project. With this, we’re happy to share that at least 45% of the tokens will go to the community. We say at least, because we haven’t finalized listing agreements - which could include no listing agreements at all and merely launching $REYA on Reya. Once these decisions are confirmed, we’ll share the final allocations.

The Roadmap

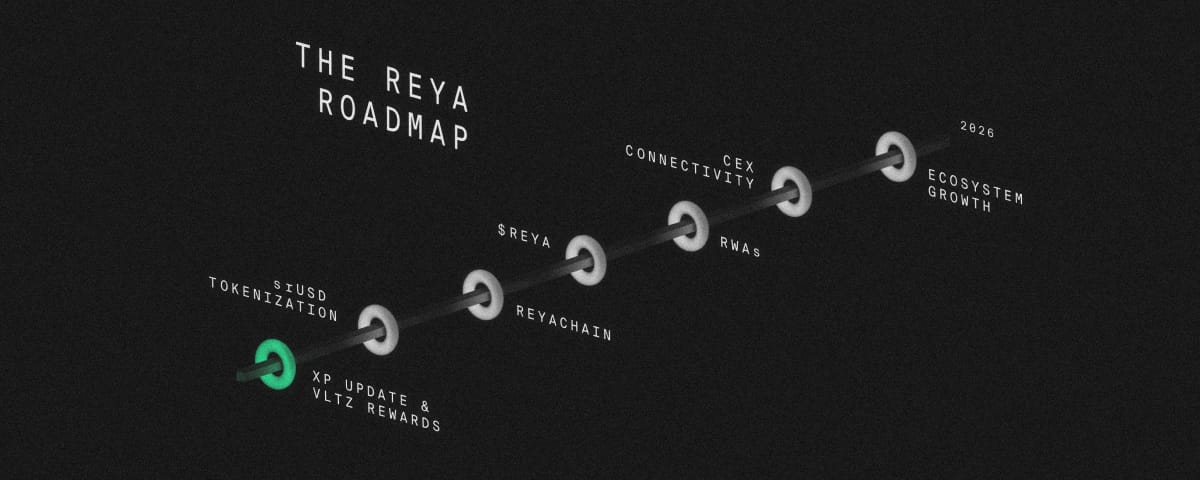

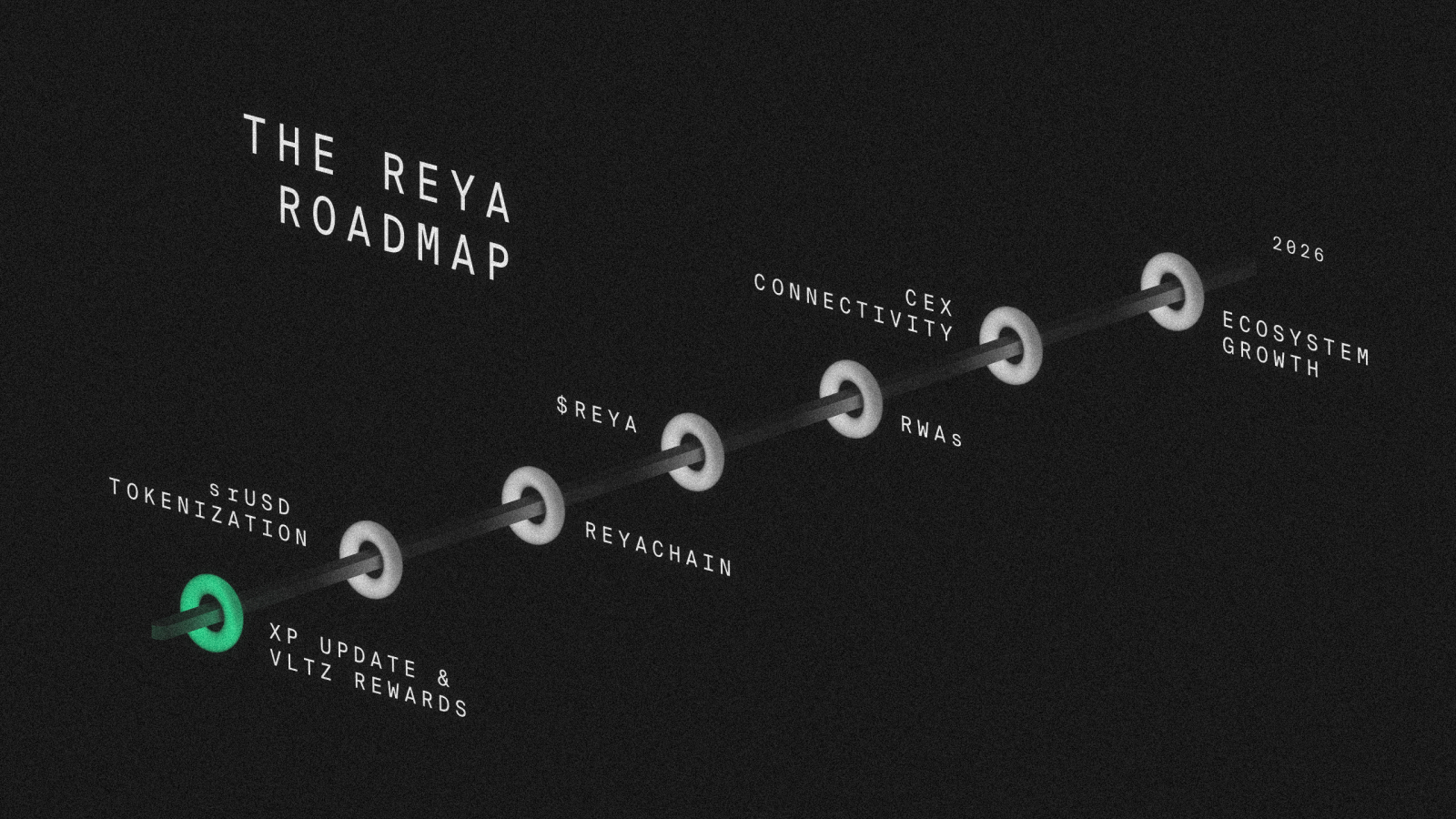

As we enter the Sprint to Sovereignty and subsequent progress on Phases 2 and 3 of the Reya Roadmap, there are a few things to look forward to:

Each milestone we’ll celebrate together as we work towards our long-term vision to create the most performant, liquid and capital efficient trading hub. The first ever such product built onchain and one that will transform global access to trading, facilitate entirely new distribution channels for funds and drive unprecedented capital efficiency benefits for sophisticated traders.

This was never about choosing between DeFi, CeFi or TradFi.

It’s about unifying them, onchain.

Open access. Institutional scale. Onchain performance.

Owned by the users.

Powered by $REYA.

The fragmentation is ending. The unification is beginning.