BTC Funding Rate Arbitrage: The Arb Trade You’re Missing on Reya

BTC funding on Reya has sat between −15% and −20% (annualized) since Friday.Many CEXs are around +10%.That’s a 30% annualized spread.And it pays both ways.

Provide a caption (optional)Go long BTC perp on Reya while funding is negative.You receive funding on the long.Go short BTC perp on a CEX where funding is positive.You receive funding there too.Price risk offsets. You earn the carry — and climb the Open Interest leaderboard while you do it.Reya’s funding stays stable, but when it drifts from CEXs, it creates real, tradable edge.This week’s divergence is a gift.

Worked math

- Notional: $1,000,000

- Spread: 30% annualized

- Per 8h window ≈ 0.027% → $270 per leg

- Three windows per day = ~$810/day

- $2M ≈ $1,620/day at the same spread

And that’s before counting Reya Chain Points from OI.

Price spread risk

Funding rate arbs are susceptible to changes in price spread between the two venues. Reya’s pegging guarantees you always profit from the spread if you time your entry/exit correctly: just always trade while rebalancing the pool. The dynamic funding rate means this is connected with the direction of the rate.

How to time it

Reya’s AMM pegs to CEX prices with a dynamic funding rate, so the pool’s net position tells you where spreads and funding are heading.

- AMM net long → Reya price below CEX, funding decreasing.That’s your entry.

- AMM net short → Reya price above CEX, funding increasing.That’s your exit.

Enter when funding is falling, exit when it rising.

Why you profit

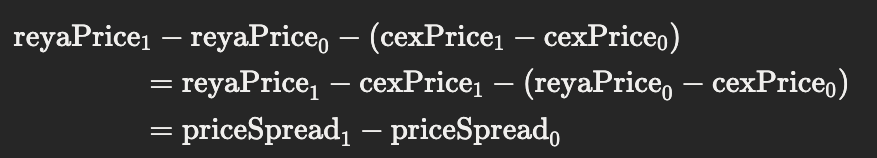

Express your price PnL in terms of the price spread between Reya and the CEXs:

- in these terms:when the amm is long, the price spread is negative

when the amm is short, the price spread is positive - so, if you go long on Reya when the AMM is long, hedging on the CEX, then unwind when the AMM is net short, we have

- priceSpread₀ < 0 and priceSpread₁ > 0

- so, priceSpread₁ − priceSpread₀ > 0

- Now, here’s the trick: the funding rates always move in the direction of the price spread:if the price spread is negative, the funding rate is decreasing if the price spread is positive, the funding rate is increasing

Concrete BTC setup from the desk

- Wait for Reya BTC funding < −15% and still decreasing.

- Enter: Long Reya, short CEX.

- Hold the OI. Collect funding + RCP.

- Exit as Reya funding climbs back toward +10% and starts increasing.

Checklist before you size

- Align funding windows across venues.

- Hedge instantly to avoid leg drift.

- Maintain margin headroom.

- Don’t flip the pool’s direction.

Reya’s depth lets you size without moving price.The AMM’s design means spreads move toward you as funding normalizes.

Summary

- Find divergence.

- Trade the spread.

- Hold OI.

- Earn the carry.

- Stack RCP.

- Both legs pay you.

- You’re long the edge, not the direction.

BTC funding divergence has already delivered double-digit carry this week.

ETH markets are starting to move next.

Check rates, size smart, and make the basis work for you.

The quant desks are watching. You should be too.

Trade on Reya now to take advantage of strategies like this today

app.reya.xyz

Reya. Ethereum for traders