Ethereum won settlement

Ethereum has already won something important: settlement.Stablecoin supply, tokenized treasuries, institutional collateral, the core assets of digital finance overwhelmingly anchor to Ethereum. The majority of stablecoin liquidity still settles there. As of early 2026, Ethereum (mainnet) hosts roughly 50–60% of total stablecoin supply, representing well over $150B+ in dollar-denominated liquidity.When serious capital enters crypto, it touches Ethereum first.Ethereum also dominates tokenized real-world assets. More than 70% of tokenized U.S. Treasury products — including BlackRock’s BUIDL and Franklin Templeton’s BENJI — are issued on Ethereum. In aggregate, Ethereum captures the clear majority of institutional RWA issuance by value.No other single chain comes close to Ethereum’s share of canonical USDC and institutional-grade issuance. This is not ideological, it is structural. Ethereum optimized for credible neutrality, security, and long-term guarantees. In finance, guarantees compound, and capital concentrates where rules are stable.

liquidity is on ethereum

— rip.eth (@ripeth) September 30, 2025

by far pic.twitter.com/p4ukoIohzn

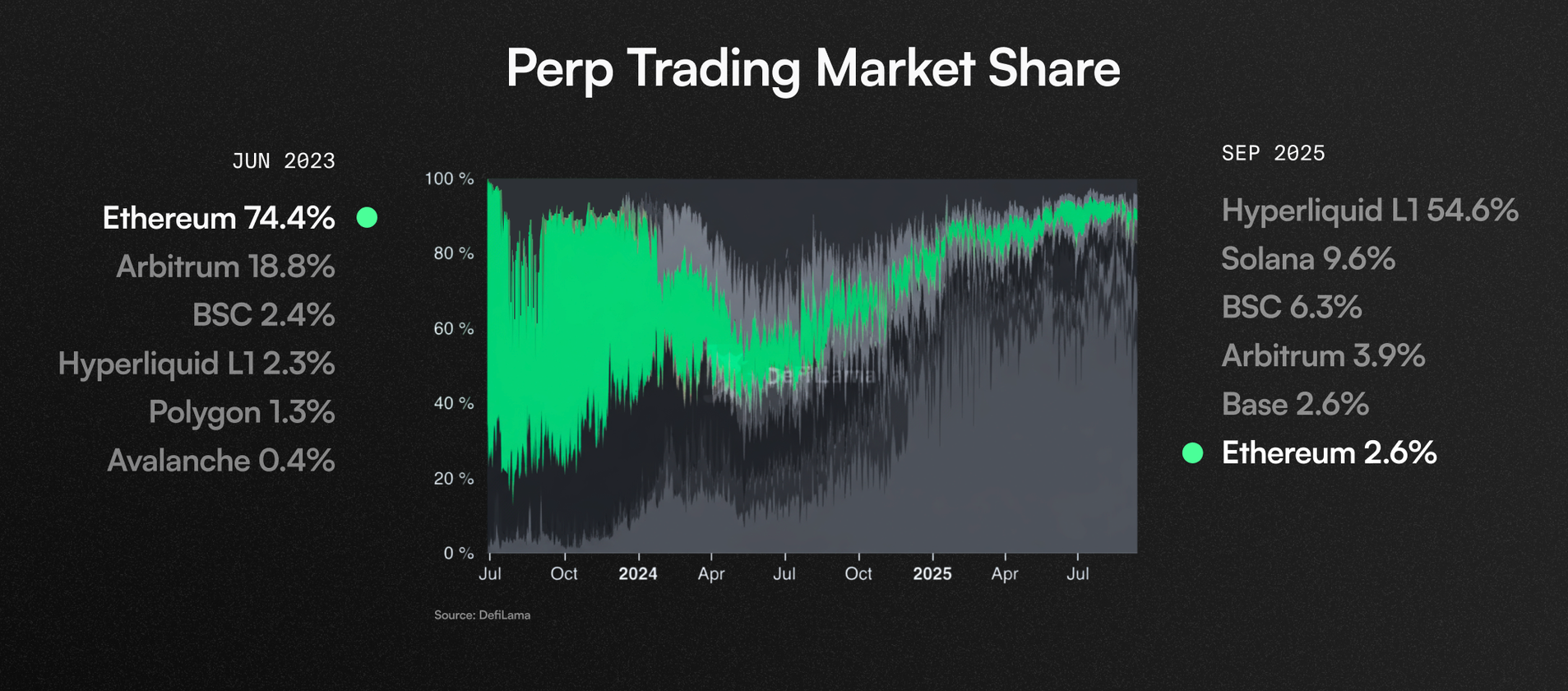

But trading has moved elsewhere

But settlement is not the same as execution. Settlement requires security. Execution requires depth, latency, determinism, and continuous rebalancing.Markets are governed by microstructure. A functioning trading venue needs:

- Predictable ordering

- Deep liquidity under stress

- Tight spreads

- Fast hedging

- Capital efficiency across spot and derivatives

And here is the structural shift: while settlement consolidated on Ethereum, execution has increasingly migrated to environments outside the Ethereum ecosystem — including alt-L1s and specialized chains designed around trading performance.On-chain perpetual trading has grown rapidly. But the deepest liquidity and largest open interest have not concentrated on Ethereum L1 or general-purpose Ethereum L2s. Instead, execution has clustered on other chains where microstructure constraints are optimized.

As an example, in 2024–2025, non-Ethereum ecosystems have frequently captured 40–60% of total on-chain perpetual trading volume, with some specialized chains individually exceeding Ethereum L1 and L2 combined in monthly perp volume.

The result is fragmentation

So, capital sits on Ethereum; execution happens elsewhere. This separation between settlement and execution creates friction.The impact is twofold.First, fragmentation is economically inefficient. Capital that could be deployed cohesively becomes siloed. Liquidity that could reinforce itself instead competes across ecosystems. Depth thins. Funding rates diverge. Arbitrage widens spreads rather than compressing them. The result is a structurally higher cost of capital and a degraded trading experience.Second — and more importantly for long-term market structure — the properties that made institutions comfortable settling on Ethereum are lost at the execution layer.Institutions choose Ethereum because of its credible neutrality, transparent governance, and hardened security assumptions. But when trading migrates to specialized environments outside the Ethereum ecosystem, those guarantees no longer apply in the same way. Execution takes place in systems with different trust assumptions.In traditional markets, clearing, execution, and margin systems are segregated into different functions to ensure financial safety, but they are architected to reinforce each other. For example, a clearinghouse always holds your funds while execution might take place in a variety of exchanges; this means that your settlement guarantees are preserved.In DeFi, settlement and execution have been split in completely segregated components, so that access to performant execution environments requires you to actually move capital to chains with lower security guarantees. That split might have been acceptable for early experimentation, but as markets scale there are increasing costs to this fragmentation, through capital inefficiency, reduced depth, and degraded user experience.Ethereum secured the balance sheet; it is now time for its execution layer to catch up.

Reya’s based-rollup is Ethereum’s execution layer

The important thing to understand is that this settlement/execution split is not a failure of Ethereum: it is the consequence of design priorities. Ethereum optimized for secure settlement, while optimized execution requires microstructurally-aware designs.Rollups introduced a new design space. They allow execution environments to inherit Ethereum’s security while operating with greater performance and determinism. But not all rollups are equal: most are still generic, microstructure-unaware compute environments, built to support arbitrary applications. More importantly, barely any have been able to incorporate Ethereum’s security guarantees. As Vitalik mentions in his recent tweet: “L2s are not able or willing to satisfy the properties that a true "branded shard" would require. I've even seen at least one explicitly saying that they may never want to go beyond stage 1”.This is why Reya’s roadmap matters. Reya is not building just another L2. The trajectory is towards a based rollup verifiable via zk-proofs. One that leverages Ethereum’s base-layer sequencing and security model while optimizing execution around trading microstructure.This direction aligns closely with broader conversations in the Ethereum community about rollup maturity, interoperability, and stage-2 architectures. The goal is not to push complexity into the base layer. It is to design execution environments that inherit Ethereum’s guarantees while specializing where necessary.A based rollup does precisely that:

- It anchors to Ethereum for security and sequencing.

- It avoids fragmenting trust assumptions.

- It enables deep interoperability.

- It brings execution closer to settlement, rather than further away.

The ambition is not to compete with Ethereum, it is to truly complement it in a symbiotic way.

Grabbing the institutional market

Ethereum’s success as a settlement layer is not merely technical. It reflects institutional acceptance.As pointed out above, BlackRock’s BUIDL fund, Franklin Templeton’s BENJI fund, and other tokenized institutional products have chosen Ethereum as their primary issuance layer — a signal that institutional balance sheets trust Ethereum’s settlement guarantees. These institutional players require credible neutrality, predictable governance, clear trust assumptions, and infrastructure that can withstand stress.When tokenized treasuries settle on Ethereum, when stablecoin issuance concentrates there, when institutional collateral is custodied there, it is a signal that Ethereum is not just a chain; it is becoming financial infrastructure.But institutional capital does not stop at settlement. Institutions trade. They hedge. They manage inventory. They arbitrage basis. They deploy leverage carefully and systematically. And when they trade, microstructure matters enormously.Institutional liquidity behaves differently:

- It demands depth that holds under volatility.

- It compresses spreads.

- It arbitrages inefficiencies across venues.

- It stabilizes funding and basis.

- It rewards venues where risk, collateral, and execution are architected coherently.

This is why execution quality is not cosmetic — it determines whether serious capital stays.If Ethereum is the institutional settlement layer, then its execution layer must evolve to match that standard. That means:

- TradFi equivalent throughput and latency.

- Deterministic ordering.

- Tight integration between spot, perps, and collateral more generally.

- Interoperability across the Ethereum ecosystem.

- Security assumptions aligned with Ethereum itself.

This is precisely the ambition behind Reya’s based rollup trajectory. A based rollup is not simply a performance upgrade. It is a commitment to inherit Ethereum’s security and sequencing guarantees while building a market-native execution layer capable of supporting institutional trading flows.The opportunity is not to move institutions on-chain: they are already here, and they have committed to Ethereum as their settlement layer. The opportunity is in keeping them entirely within the ecosystem, making Ethereum-native execution so compelling that they never leave.Ethereum secures the assets; Reya will secure the markets.Institutional liquidity is the glue that will make that convergence thrive.