Bringing Real-Time Pricing to Life for Pro Traders

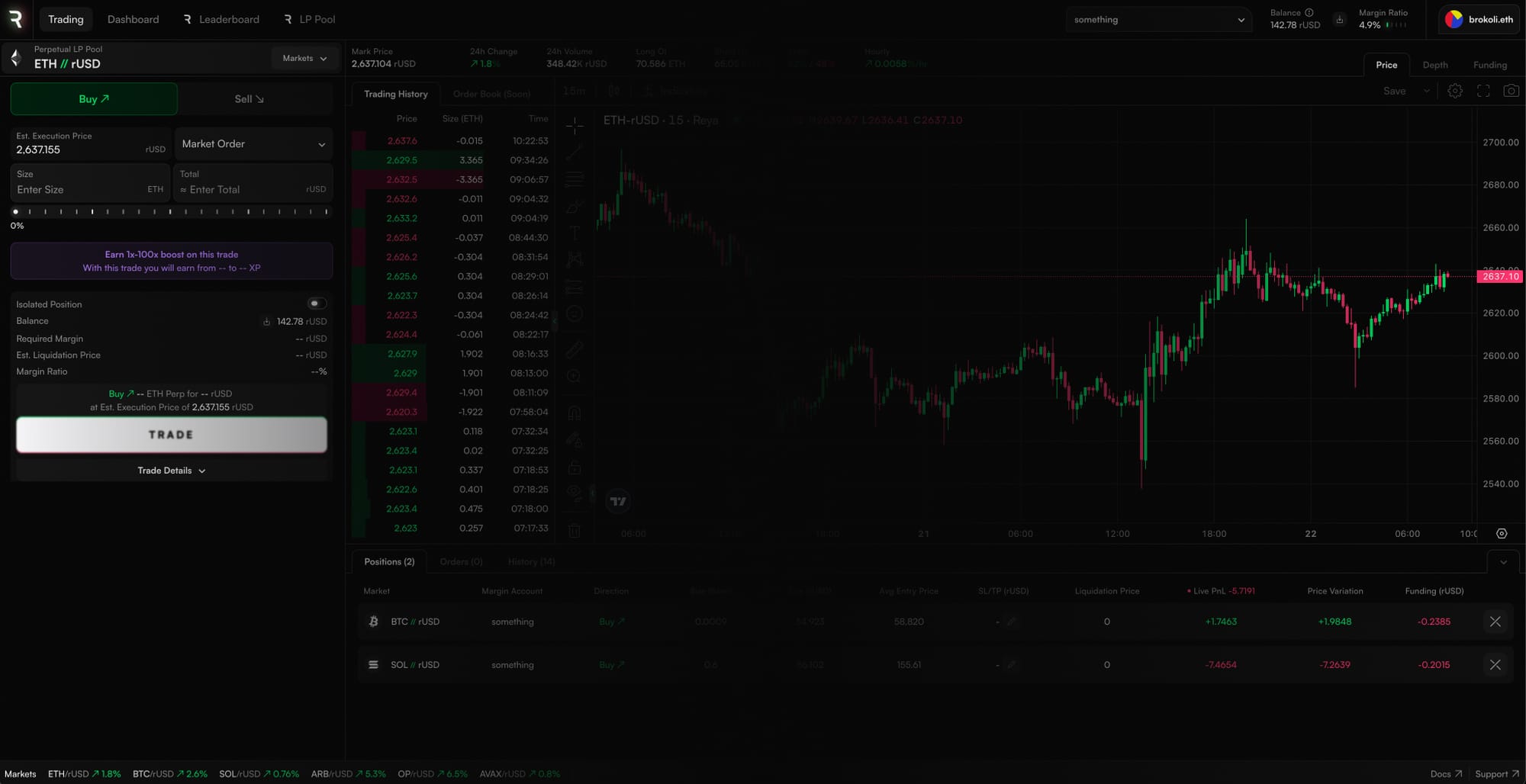

For pro traders seeking precision and speed, Reya Network's new Python reference implementation integrates Stork’s low-latency oracle for optimal trade execution. Maximize your strategy with real-time data and seamless on-chain trade execution on the world’s leading trading-optimized L2.

Speed and precision are paramount for pro traders who trade programmatically across multiple exchanges. That’s why we’re excited to introduce an easy-to-follow reference implementation for directly integrating Stork’s low-latency price data feeds into your trading strategies directly on Reya Network. This guide will help you leverage Reya’s recent integration of Stork’s real-time price data, ensuring immediate access to the best execution price.

What’s Inside the Reference Implementation?

To make the most of Reya Network’s capabilities, we’re providing a comprehensive reference implementation that includes everything you need to get started:

- Code Example: A fully functional Python script demonstrating how to access real-time pricing data via Stork’s API and execute trades on Reya Network.

- Environment Setup: Detailed instructions on configuring your trading environment for optimal performance, including environment variables and necessary dependencies.

- Step-by-Step Guide: This is a clear, easy-to-follow guide that walks you through deploying and running the code in your trading setup.

- WebSocket Integration: This section provides examples of how to use Reya’s WebSocket API to subscribe to market data updates, ensuring you have the most accurate and timely information for your trades.

- Demo—On-Chain Trade Execution: This is a practical demonstration of how to execute trades on Reya DEX using real-time data, ensuring that every trade is based on the latest market conditions.

Why This Matters for Pro Traders

With this reference implementation, you can now leverage Reya Network's blockchain's unparalleled speed, combined with Stork’s real-time pricing, to achieve the best possible execution prices in your on-chain trades. Whether you're trading major assets like BTC and ETH or exploring more volatile markets, this guide will help you maximize the effectiveness of your trading strategy.

To illustrate the power of this integration, consider a scenario where you are trading a volatile asset. Reya Network’s low-latency block times and Stork’s rapid price feeds allow you to quickly detect and react to price movements, executing trades with minimal delay. This not only enhances your trade execution but also opens up opportunities for more advanced trading strategies. Using the WebSocket client, you can monitor real-time price changes and adjust your positions accordingly. For instance, if you notice a significant price shift in the ETH/USD market, your bot can automatically trigger a trade based on pre-set conditions, ensuring you capitalize on market opportunities as they arise.

As you familiarize yourself with Reya Network's services, you’ll discover new ways to minimize slippage, reduce execution time, or explore complex trading strategies like funding rate arbitrage. Reya Network’s combination of speed and precision will give you the edge you need. Check out the public GitHub repository, clone the code, and start integrating real-time pricing into your trading bots today. With Reya Network and Stork’s, you can take your trading to new heights.

Reya Network: The World's Leading Trading-Optimized L2

Reya Network is the world's leading trading-optimized Layer 2 (L2). It is built on three fundamental pillars:

- Unified Liquidity: Reya Network consolidates fragmented liquidity into a single, deep pool, reducing slippage and ensuring interoperable liquidity across the network. This, combined with the yield-bearing rUSD and dynamic funding rate, creates a stable, efficient trading environment for all users.

- Unbeatable Performance: With high-speed execution, zero gas fees, and protection against front-running, Reya delivers top-tier performance. Its decentralized clearing protocol and modular L2 architecture ensure consistent, reliable operations at an institutional scale.

- Capital Efficiency: By merging high performance with unified liquidity, Reya maximizes capital utilization through advanced cross-margining, yield-bearing assets, and strategic correlations, enabling traders to achieve optimal outcomes.