Announcing Reya Network’s Novel Constant-Product-Pegged Passive LP Pool

TLDR

- Within Reya Network there is a novel pegged constant-product mechanism for a perps passive liquidity pool. This means that the perps are pegged to the spot market through a price deviation formula derived from the constant product curve.

- Distinctly, the constant-product pegging automatically adjusts trading conditions to changes in liquidity. It also strongly disincentivizing liquidity drainage by adjusting trading prices and a dynamic funding rate through the constant-product-pegged price deviation.

- Notably, LPs will be able to offer up liquidity passively in a fully leveraged manner, potentially improving returns manifold. And the cross-margining in the pool’s exposure means trade prices are improved from aggregate trading in the pool.

- Traders will also benefit for the first time on-chain from a permanent liquidity perp that is fully (portfolio) cross-margined, with margin reductions due to correlation between assets both in their portfolio.

- Uniquely, the constant-product-pegged passive LP pool can be used by any exchange operating on Reya Network, providing a mechanism to boost liquidity and supporting clearing across exchanges.

Reya’s constant-product pegging mechanism

Reya Network is introducing a passive liquidity design with a novel constant-product pegging mechanism for perpetual futures. It will power any exchange operating on Reya Network, and allow for unprecedented capital efficiency, both for traders as well as LPs:

- traders will, for the first time on an on-chain protocol, be able to leverage positions with full (portfolio) cross-margining, which can represent a >350% increase in capital efficiency;

- LPs will, for the first time ever, be able to offer capital at collateralization ratio of less that 100% of nominal in addition to cross-margining, greatly increasing their capital efficiency;

The passive pool mechanism accomplishes this by introducing a series of new safety mechanism designs:

- the constant product pegging mechanism to the spot market together is a novel price impact function based on the constant product curve, which, uniquely, automatically adapts to changes in liquidity while incentivizing rebalancing of the pool’s exposure;

- a dynamic funding rate that is also based on the constant product pegging, further strongly incentivizing rebalancing of the pool’s net exposure by using the price impact function to determine the funding rate velocity;

- the margin system from Reya’s Derivatives Clearing mechanism, which allows for wide control of the risk profile while also enabling full (portfolio) cross margining;

- an open system trading system, which enables developers to build their exchanges on top of the instrument and clearing systems, further incentivizing liquidity and open trading in Reya Network.

At heart, the constant-product-pegged passive liquidity mechanism is a market making model that provides the best features of a traditional constant product AMM while allowing LPs to offer price-passive liquidity in a highly efficient manner. This means that LPs who do not have the means or expertise for continuously price crypto assets can still fully leverage their capital and collect a full yield for adding liquidity to the market.

To enable price-passive LPing, the passive LP mechanism makes full use of the spot market prices, which can be used to index the futures. It also aggregates all liquidity, creating a unique interface between makers and takers. Finally, the price impact function based on the constant curve not only automatically adjusts to changes in liquidity conditions, but also strongly disincentivizes liquidity drainage.

We will explore perp trading in Reya Network’s passive pool mechanism in more detail below. But let’s first see what this means for LPs.

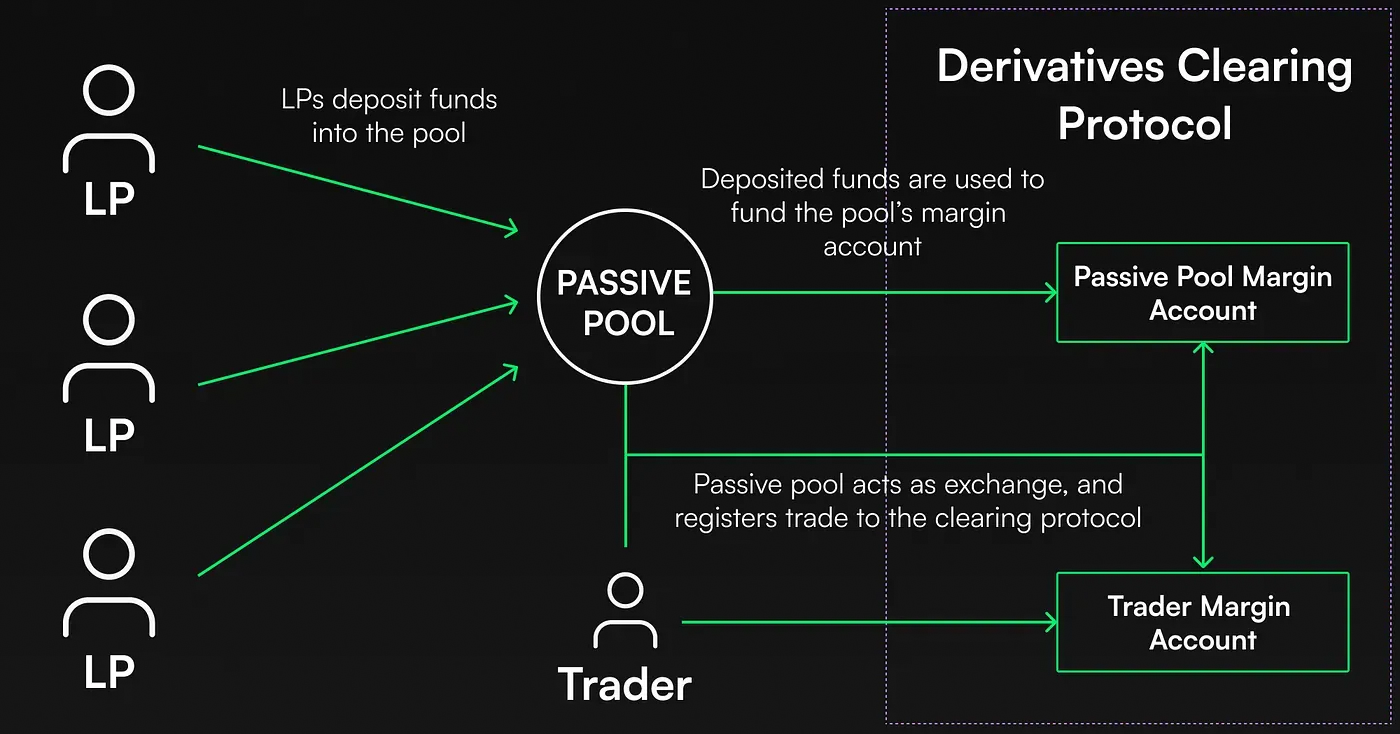

Offering liquidity in the passive pool

Reya Network offers passive LPs the opportunity to provide liquidity in a fully leveraged manner to earn potential yield. This is segregated via a special account for providing liquidity to the passive mechanism, distinct from a participants trading margin account. The deposited funds are used to bridge between long and short open interests, as the pool acts as a temporary counterparty who makes up the market’s net imbalance: every trader comes in and trades against the passive pool, and as the pool nets off long and short positions against each other, it retains only a net exposure

Consider the following stylized example, where we see the passive pool working as the ‘bridge’ ultimately matching of A against B and C:

Uniquely, Reya Network’s constant-product pegging automatically adjusts both trade prices and the funding rate in response to liquidity changes: increasing the price impact and the funding rate if liquidity were drained; but also improving trading conditions in response to increases in liquidity both from new deposits and accumulated PnL. It does so according a price deviation based on the constant product curve.

LPing is further optimized because it will be leveraged: each trade will require less than the 100% of nominal required from LPs in similar protocols. This can be a manifold boost to returns. For example, suppose

- an asset trades at 20x leverage in isolated mode;

- the passive pool’s IMR multiple is 4 — meaning the pool locks 4 times the initial margin requirement for any trade as a safety mechanism.

Each unit of exposure will require 4x.05=.20 of nominal, and passive LPs could get up to 5x the return obtained elsewhere — without even considering cross-margining effects!

Where does the return come from? For making their capital available, passive LPs get a share of

- trading profits from the trade prices occurring at different trade prices;

- funding rate the pool accrues for temporarily standing as a counterparty to the larger open interest side;

- 60% of all trading fees derived from the passive pool, which is programmatically share with them (note: this proportion is settable by Reya Network governance);

All told, Reya Network is the next generation of passive LPing!

Trading in the passive pool mechanism

The pegging model

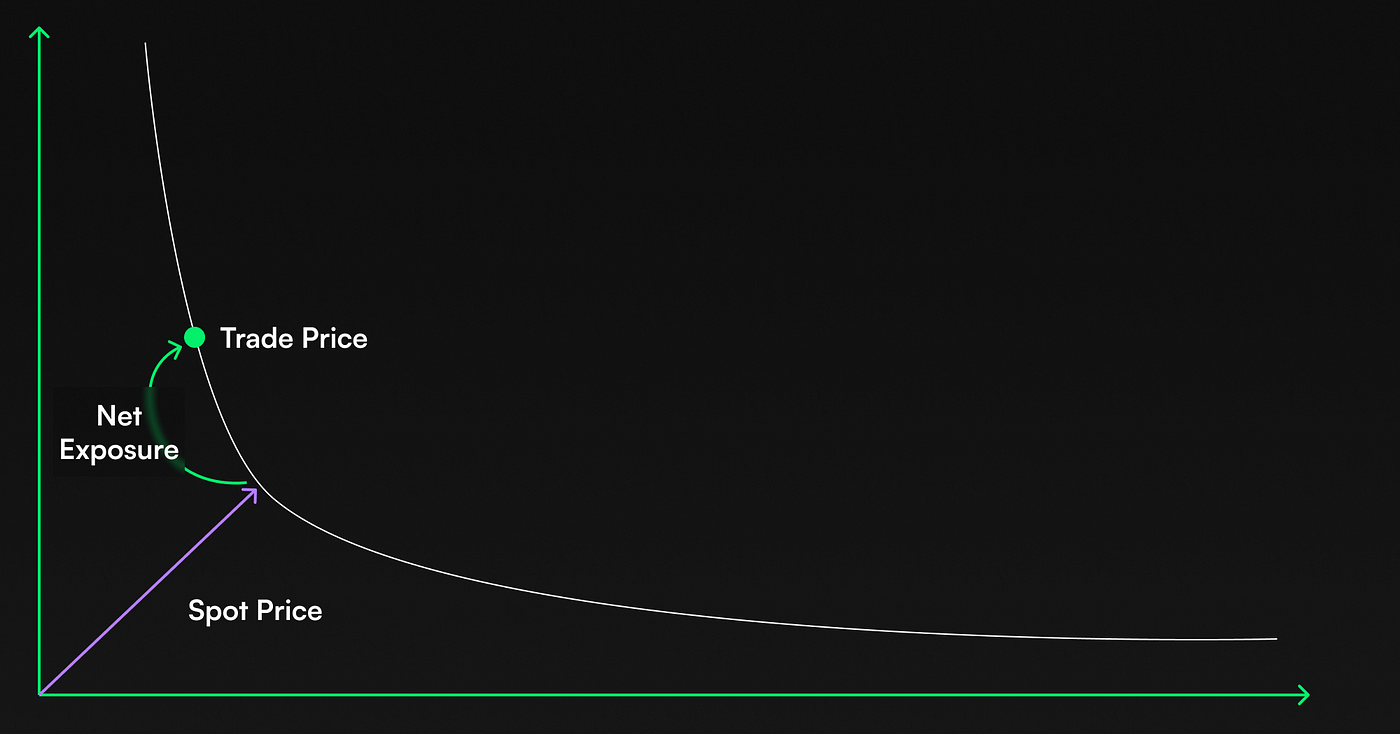

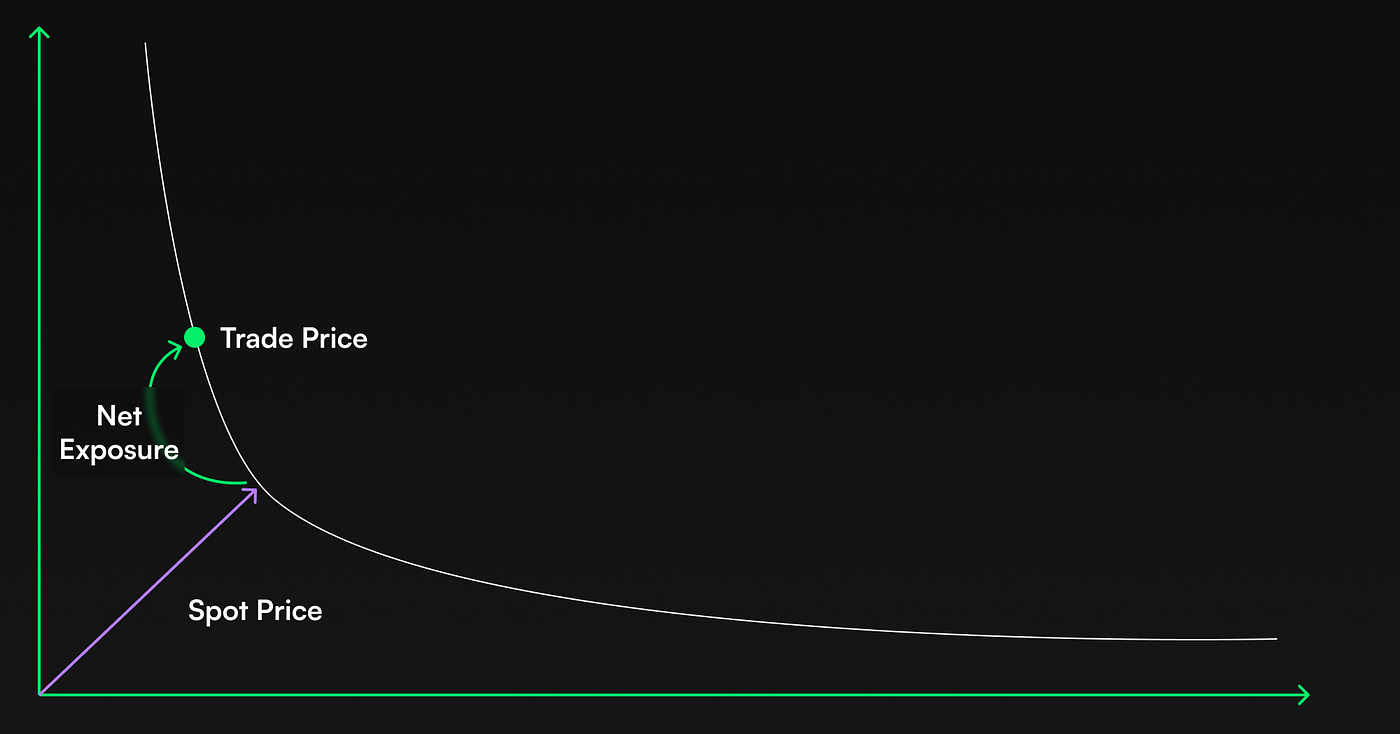

Reya’s constant-product pegging mechanism takes into consideration:

- the spot price

- the available liquidity in the pool;

- the pool’s net exposure.

It uses the slippage implied by the constant product curve known, for example, from Uniswap and other AMMs. It immediately adjusts trade prices in response to any of these three variable:

where maxExposure incorporates the present liquidity conditions. Here,

is the pool’s net exposure after the trade.

Notice a couple of important features of the pegging formula:

- if there is no net exposure (i.e., the long and short sides are perfectly balanced), the quoted price is actually the spot price;

- however, whenever previous trades cause an imbalance, the price gets adjusted in a way that disincentivizes further unbalancing, and does so increasingly stronger.

But what is the pool’s maximal exposure? Focusing on the isolated case for simplicity, suppose the pool has some amount C of capital deposited to back its positions. Instead of transacting a unit of the asset, each perp will block a portion, say MR, of this capital as margin; this is at minimum the initial margin requirement, but can also be a multiple of it for conservative reasons. Knowing this, the maximum exposure that the pool can take is

Let’s work out a numerical example: suppose

- ETH trades at 20x leverage

- the passive pool has $10,000,000 in deposited as capital

- the pool covers precisely the IMR for each unit

- the price of ETH is $2000

So, MR=2,000/20=100 and maxExposure = 100,000.

Imagine a long trade comes in for 60ETH, resulting net exposure after the trade is of -60ETH (negative because the pool goes short against the trader). If the spot price is $2000/ETH, the trade price is going to be 6bp worse for trader:

This price deviation is approximately linear when the trade volume is much smaller that the maximum exposure, but as it approaches the limit, the constant product effect kicks in and it quickly shoots up. This is a consequence of pegging using the constant product curve.

Note finally how if the available capital changes, the maxExposure does as well, immediately impacting prices.

Marking to market

Once a trade price is determined, the spot market price also determines the interchanges of cashflows between perp counterparties. Put another way, spot market prices also determine the mark to market of the perpetual futures.

In Reya Network perps, this mark to market due to price variation is credited initially to the account’s unrealized PnL. For Reya’s passive perps, this price variation is computed using the spot price consistent with the pegging.

But one must be careful, because the PnL of the trade is ultimately determined by the exit price, and not by the intermediate price differences. That exit price is again a transaction price and will be subject to the price deviation determined by the net exposure at exit time.

The funding rate

The other component of PnL when trading a perp is the funding rate. The funding rate incentivizes convergence of trade prices to the spot price. Alternatively, the funding rate incentivized rebalancing of the pool (since price deviation is determined by net exposure).

For example, it is positive when the trade prices are above spot prices and it is paid out from longs to shorts either to incentivize existing longs to close their positions, or new traders to enter new short ones.

Rather than a traditional funding rate mechanism, Reya Network uses a dynamic funding rate, introduced by Synthetix, adapted to the constant-product pegging. In a dynamic funding rate, the price deviation determines not the funding rate itself, but its velocity:

Reality check this yourself: what happens when net exposure is negative?

If nothing changed, under a traditional funding rate, we would incentivize convergence between the two prices by charging, every one-hour period, the amount

In other words, one hour after a change in net exposure, the velocity will add precisely the amount that the normal funding rate would charge. However, a dynamic funding rate will keep increasing until the pool is rebalanced (or its net exposure changes sign).

The main advantage of a dynamic funding rate is that by constantly increasing or decreasing, it eventually reaches levels that incentivize rebalancing even for illiquid assets. Furthermore, it creates a dynamic where the pool’s net exposure tends to oscillate around balance rather than reaching balance and staying there — further incentivizing trading.

The use of a dynamic funding rate should provide very interesting incentives for traders to arbitrage the passive pool against other venues. Keep an eye out for opportunities!

Cross-margining

Deploying the passive liquidity mechanism on Reya Network unlocks of full (portfolio) cross-margining: margin requirements are reduced for offsetting positions in highly correlated assets. This will in fact be enabled both for traders and the pool itself.

As a consequence, traders not only can see their margin requirements reduced, but they might actually benefit from aggregate trading in the pool: offsetting positions in the net exposure might increase the maximum exposure in any given asset.

As an example, ETH and BTC have a correlation consistently over 80%. This means that if the pool is already long BTC, the maximum short exposure for ETH can be larger than in the isolated case: first the amount that offsets the existing BTC exposure so that is actually frees up capital, then whatever amount exhausts the available capital! In this example, a trader could get more advantageous prices and pay reduced funding rates when going short ETH because of the aggregate long demand in BTC!

This is the next-gen of leverage, all done onchain!